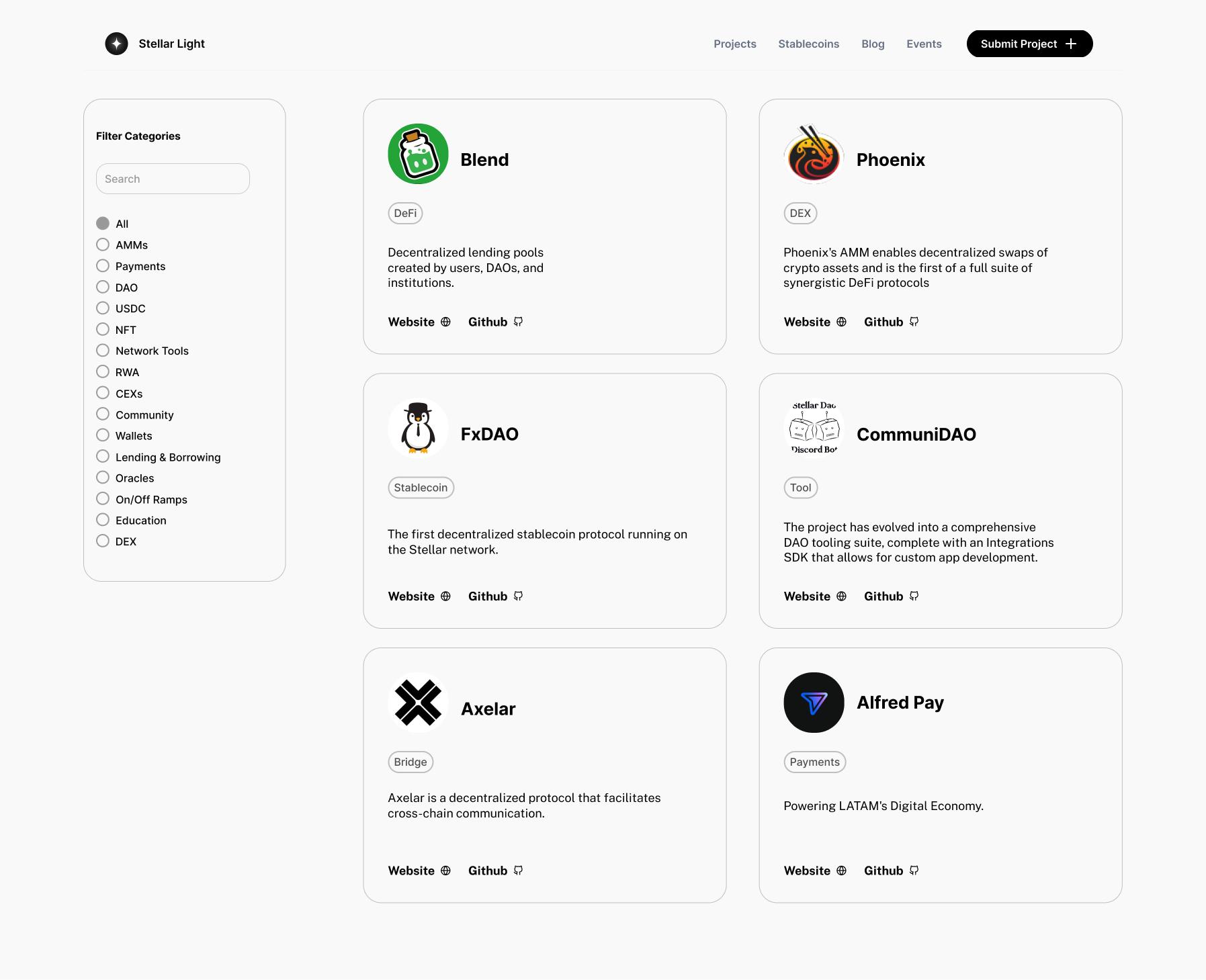

AWARDED BUILDERS,

PIONEERS & INNOVATORS

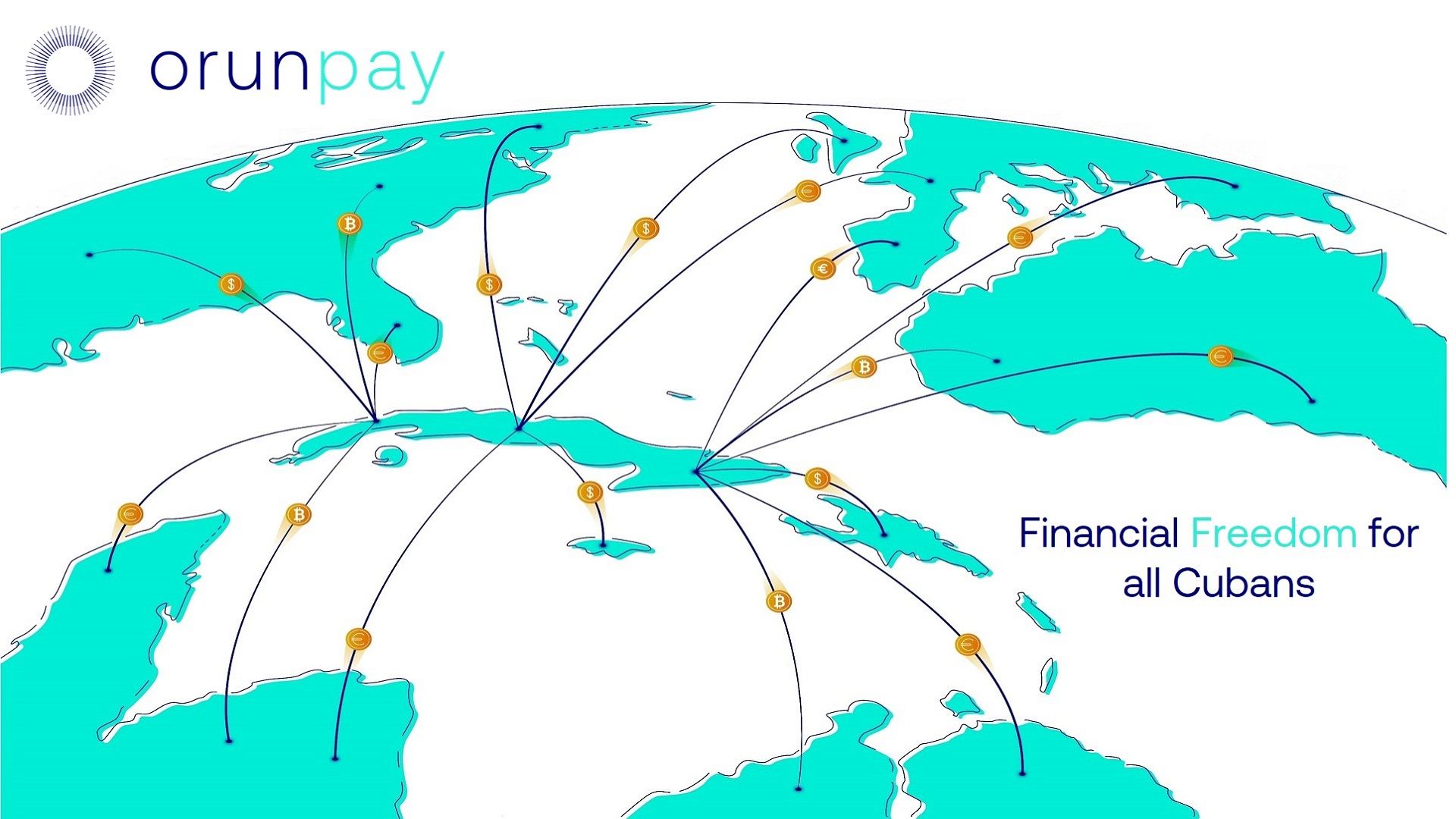

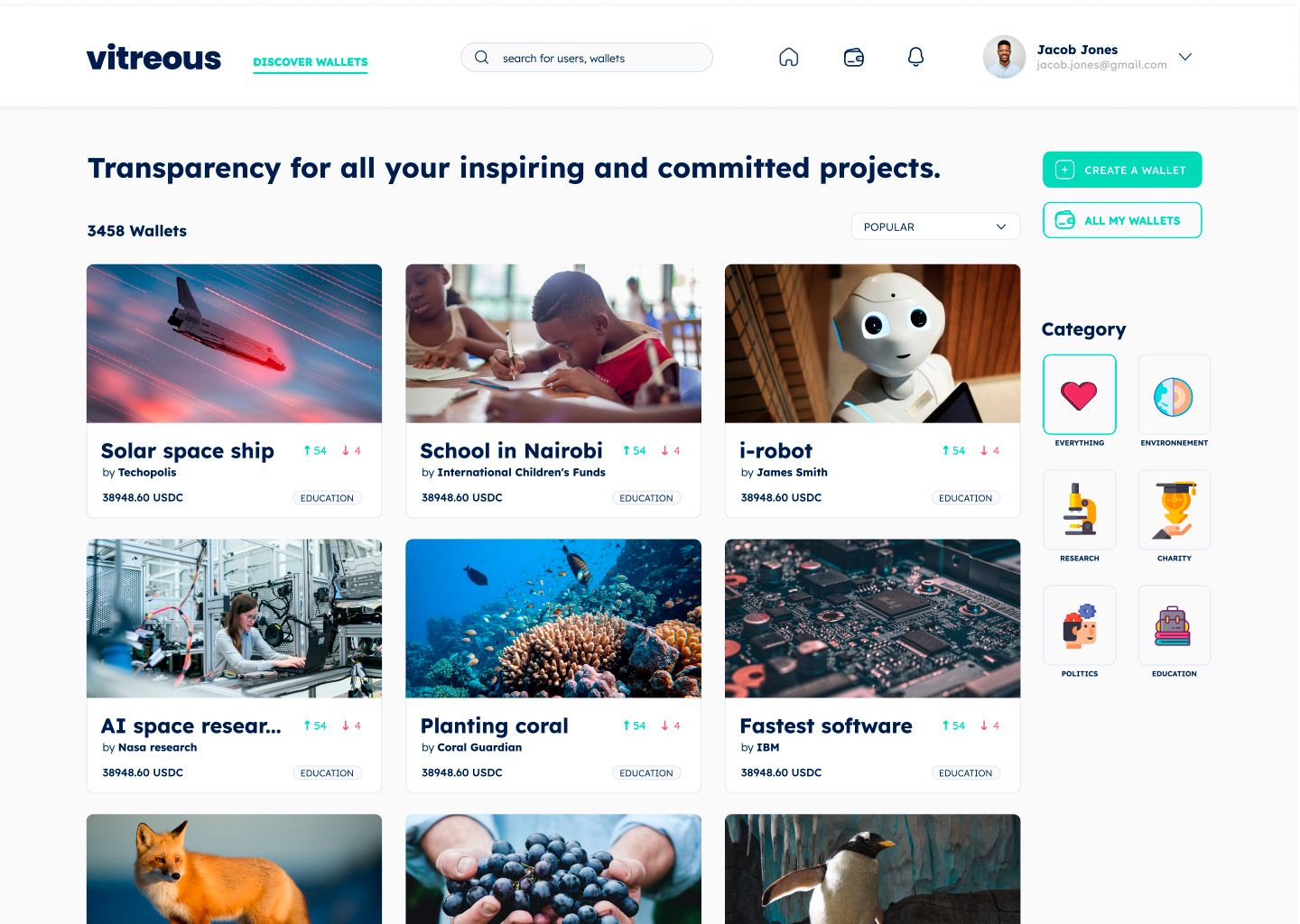

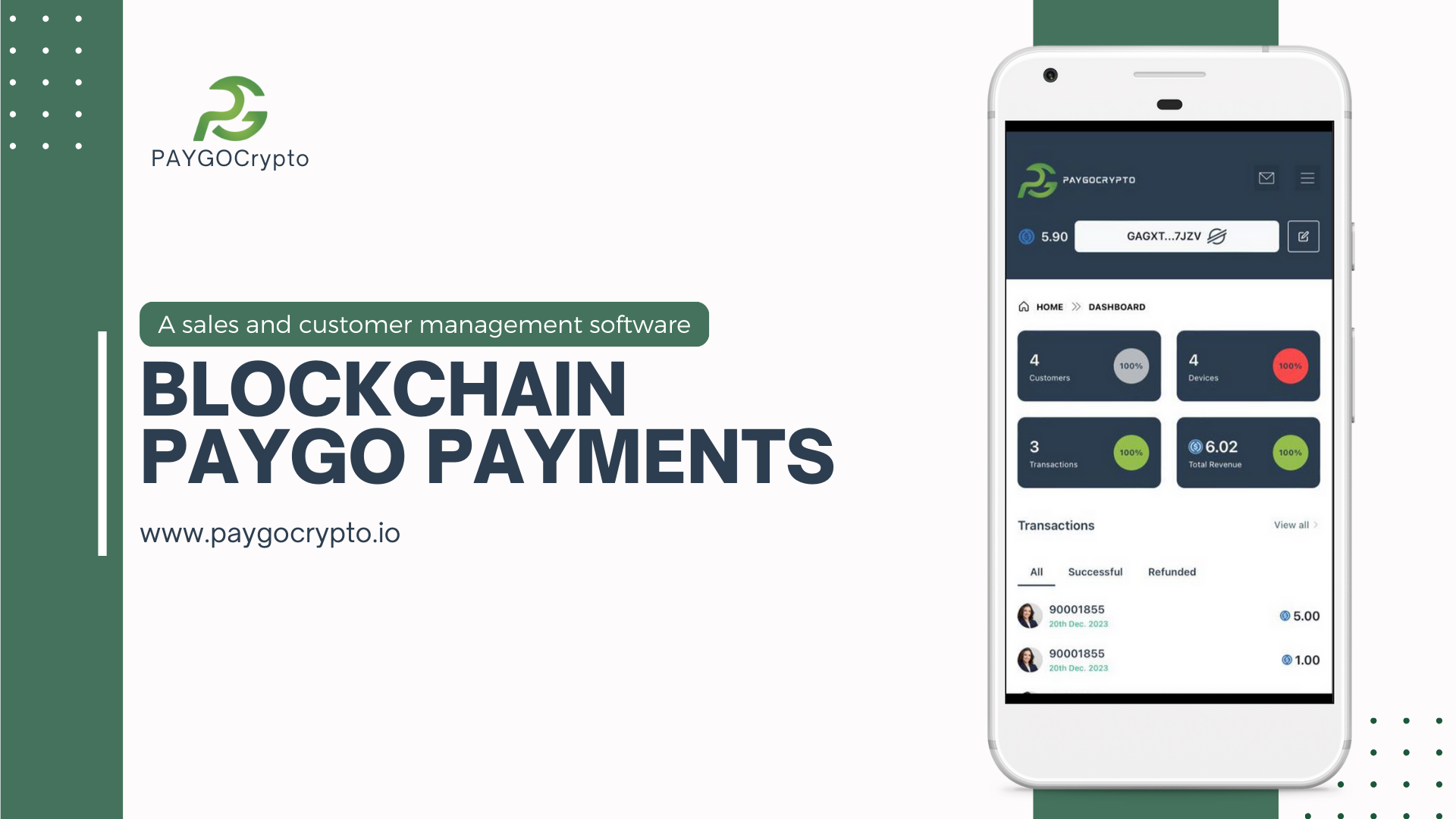

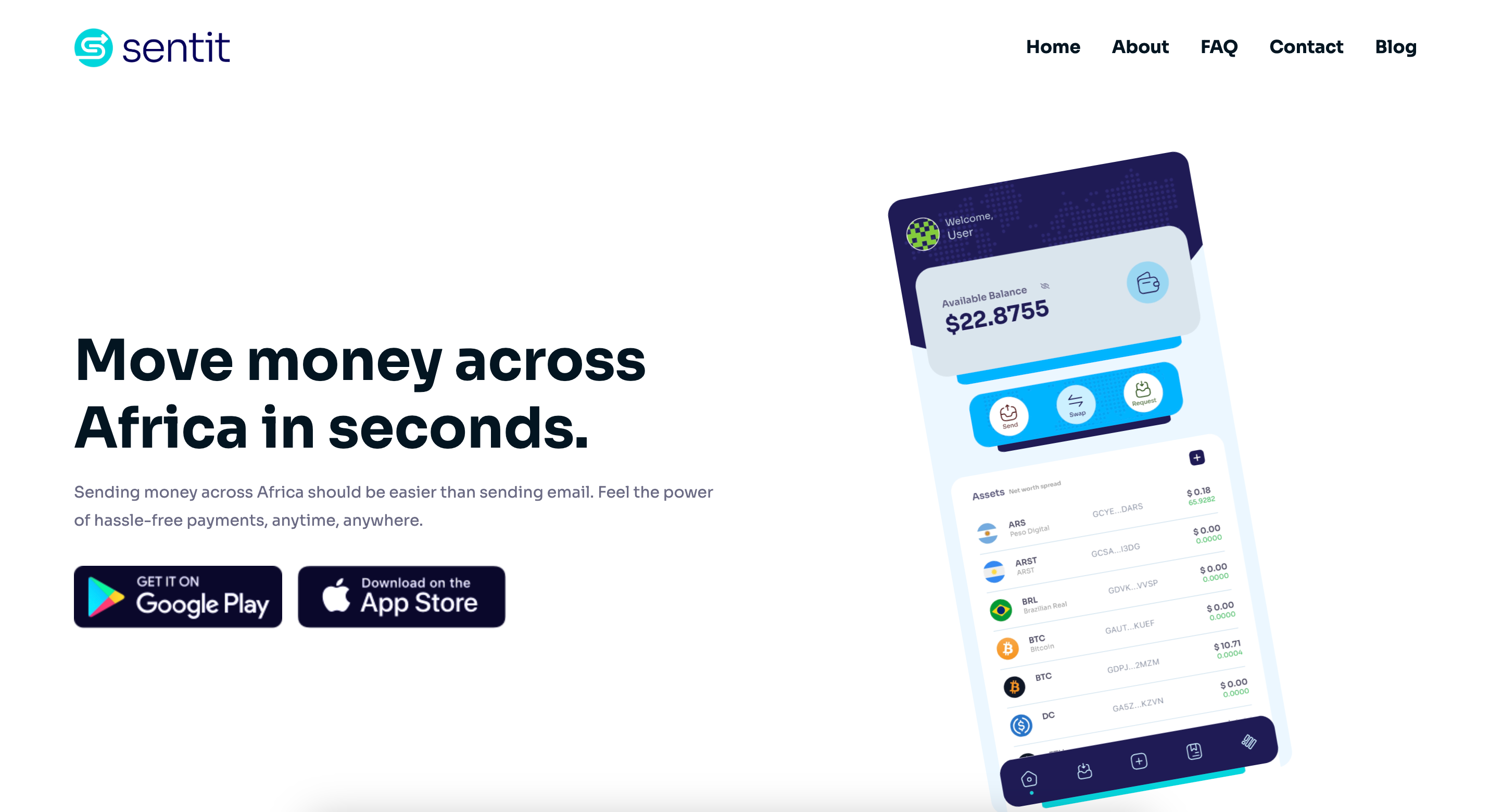

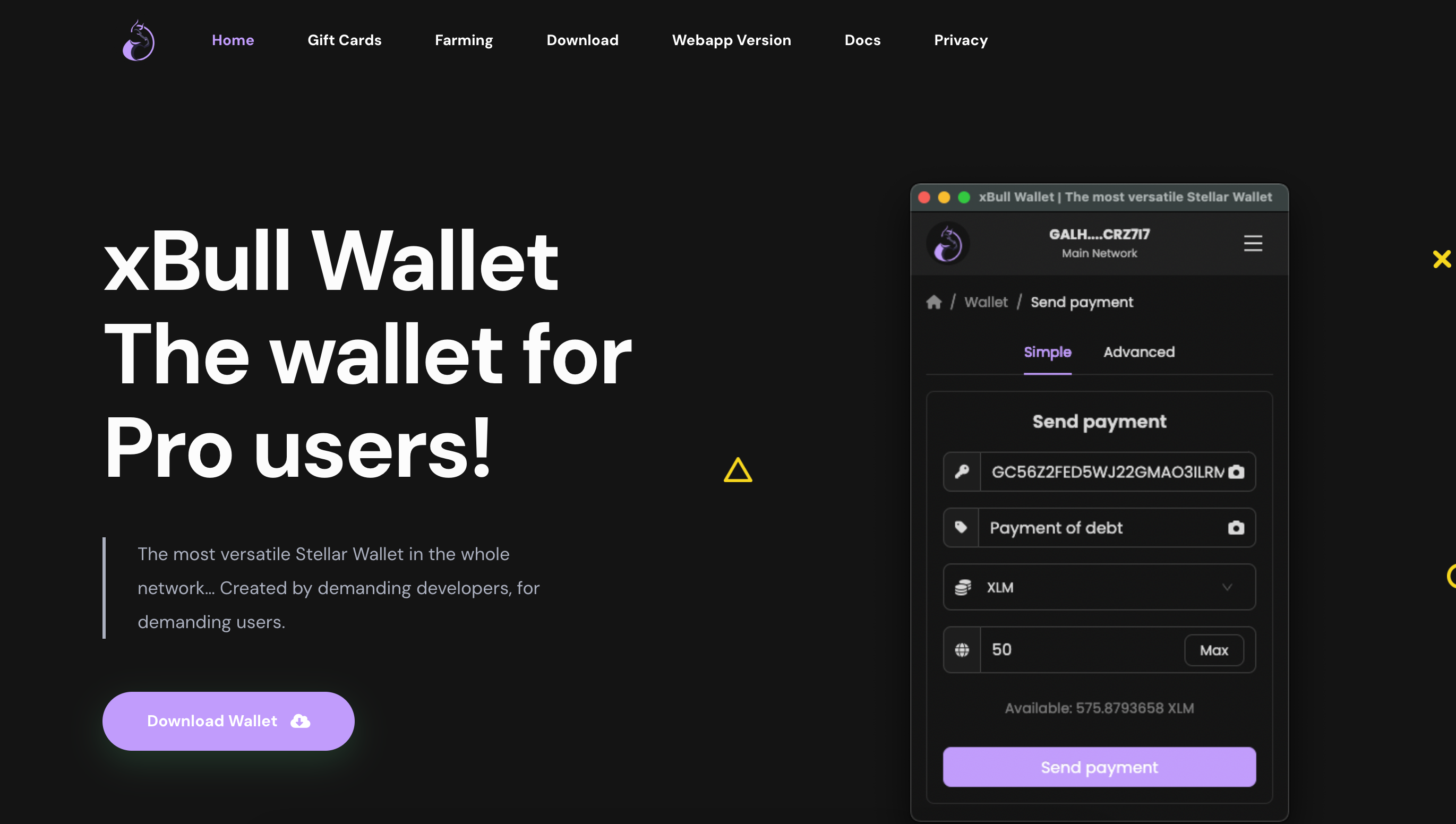

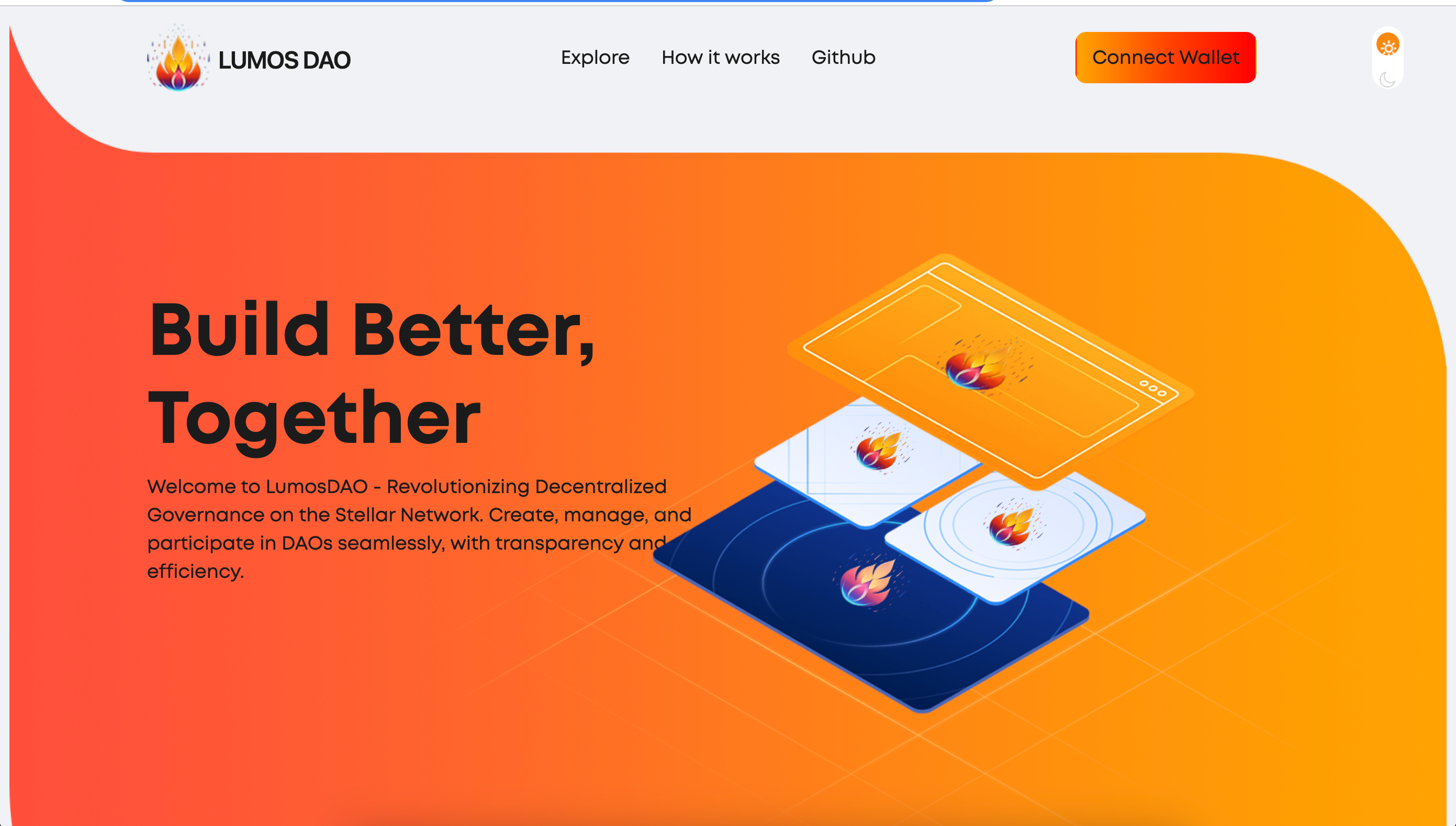

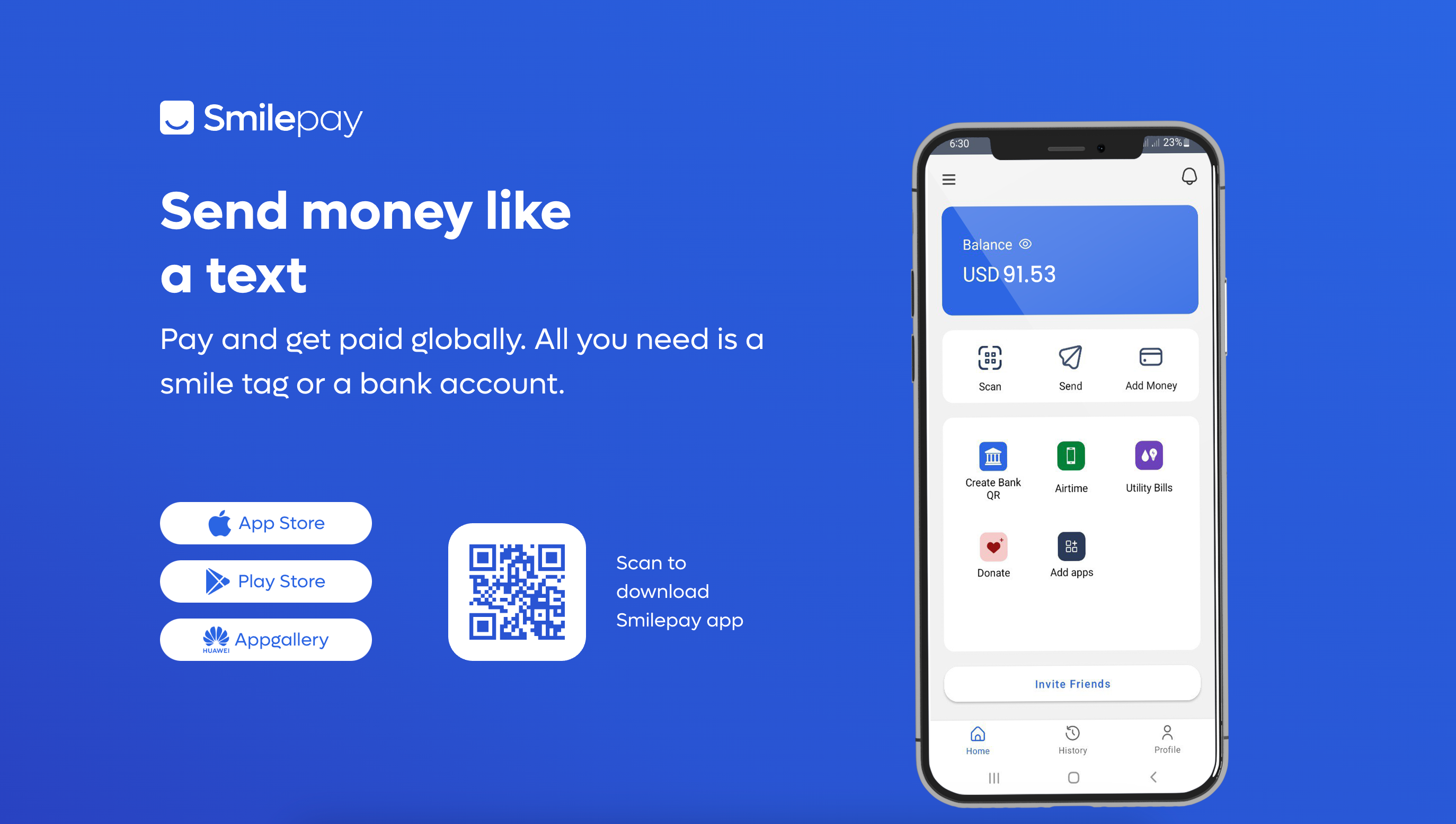

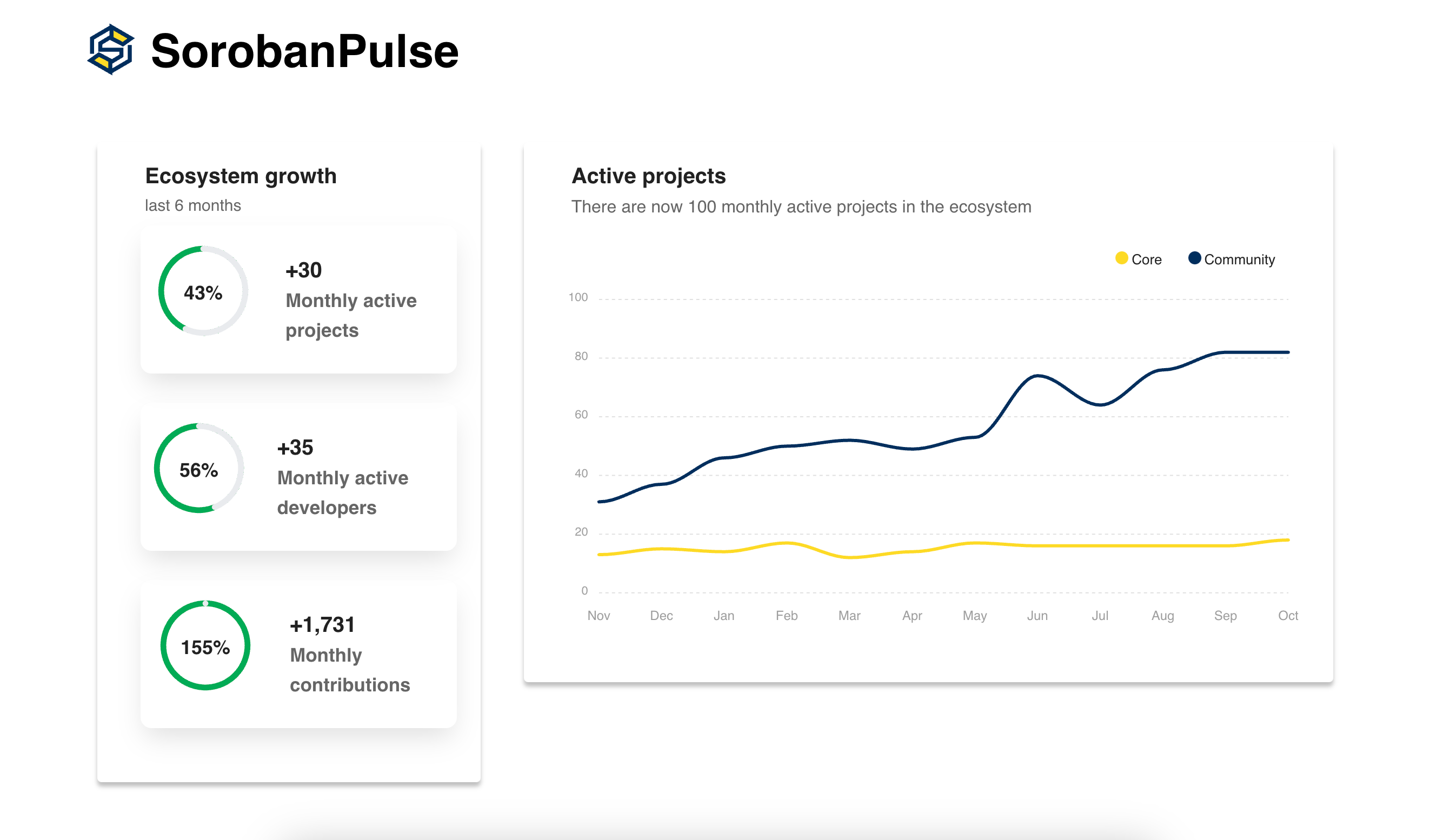

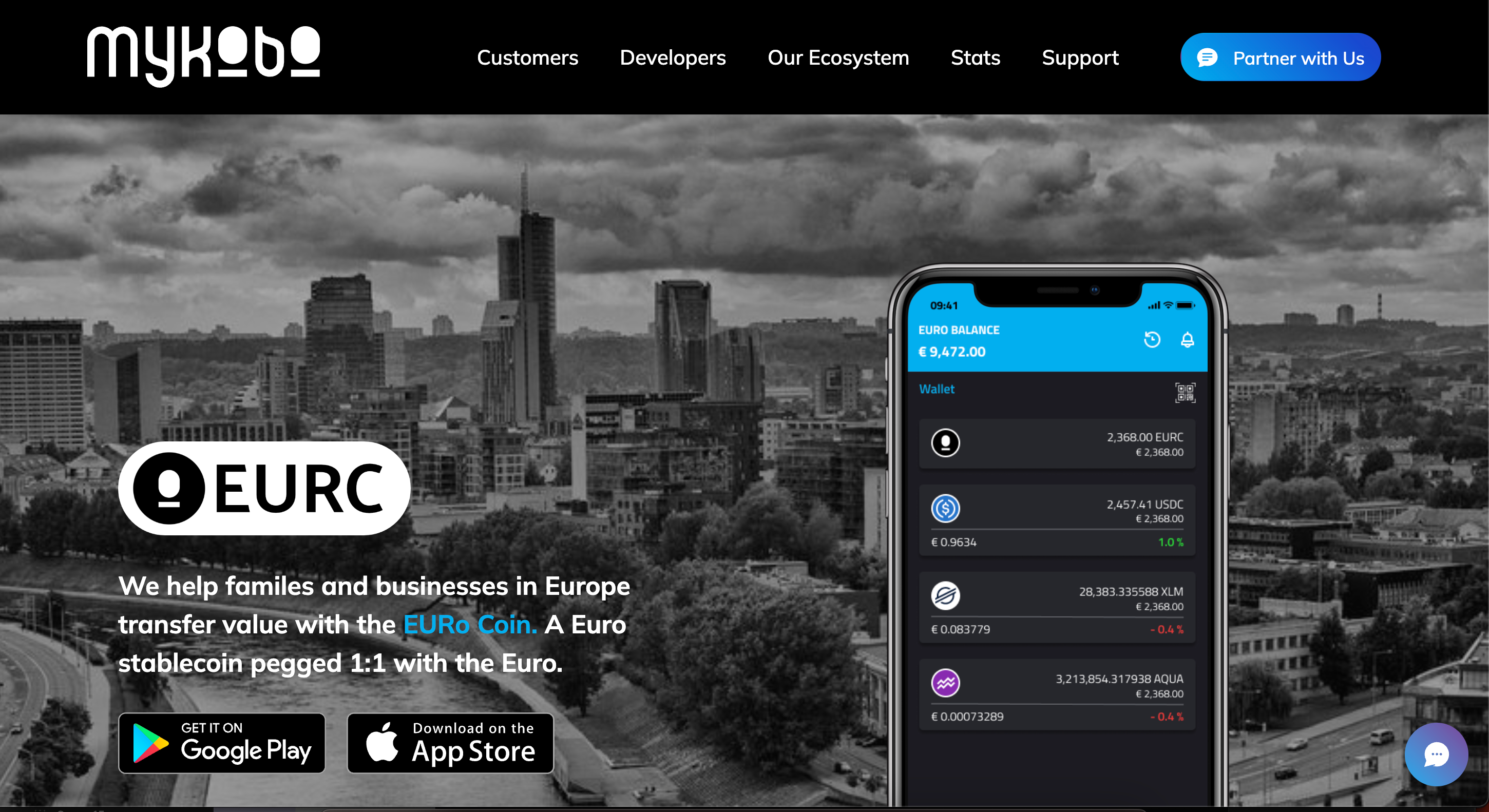

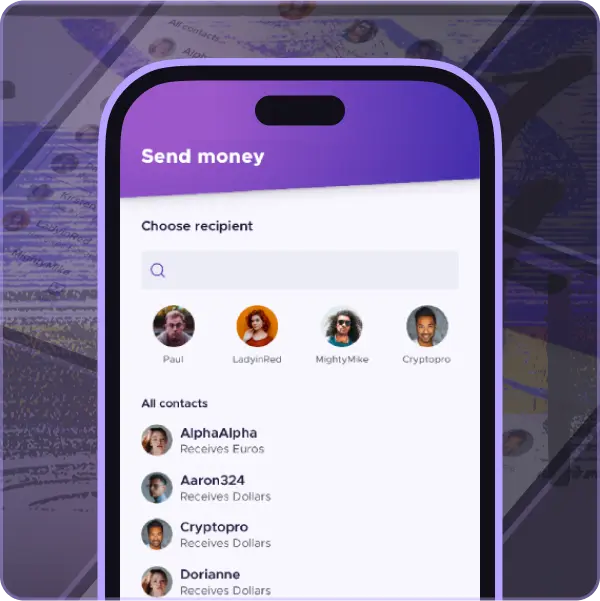

Discover the groundbreaking projects that have earned the community’s recognition. Browse through an active showcase of the Stellar network's most promising and impactful innovations, funded through SCF.

Sort by:

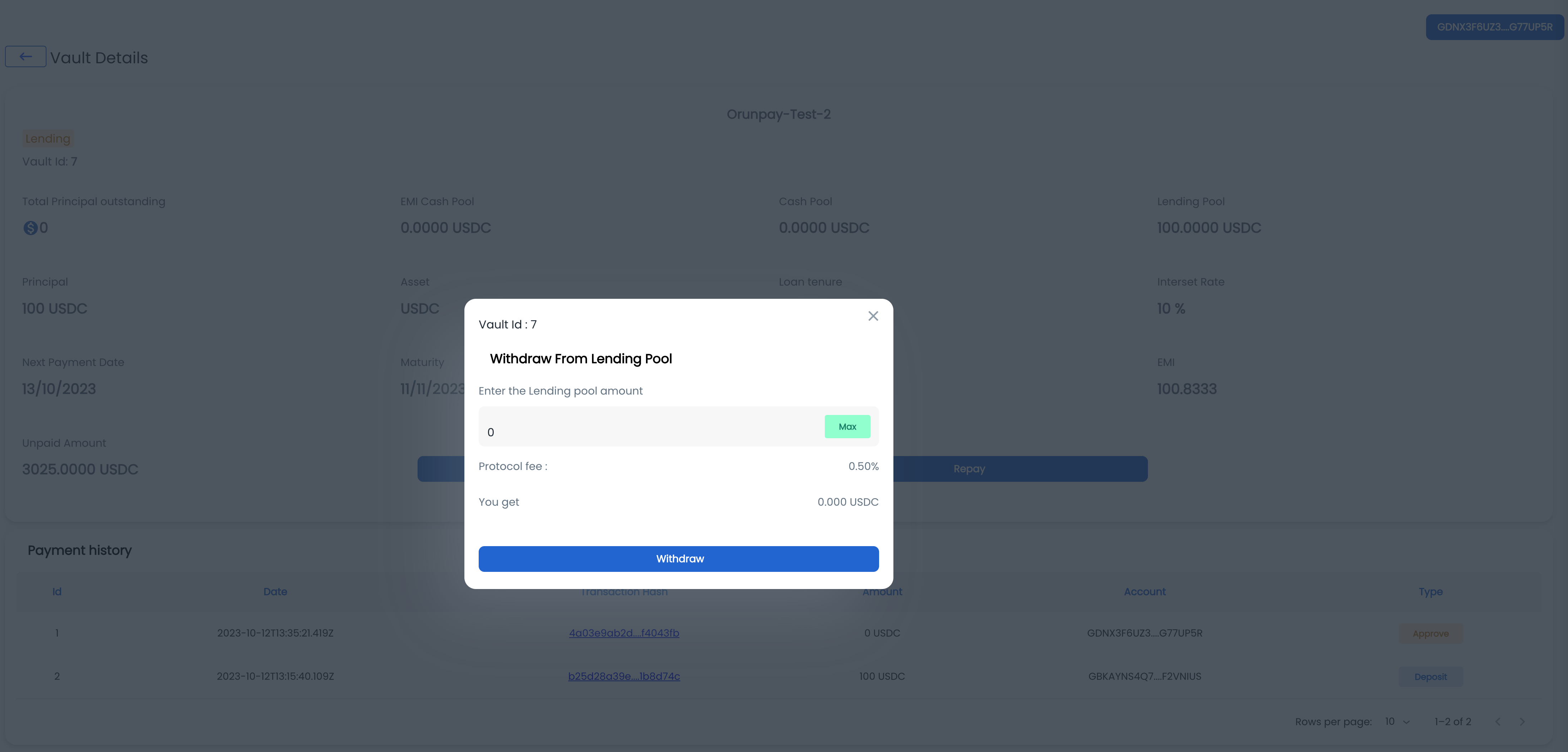

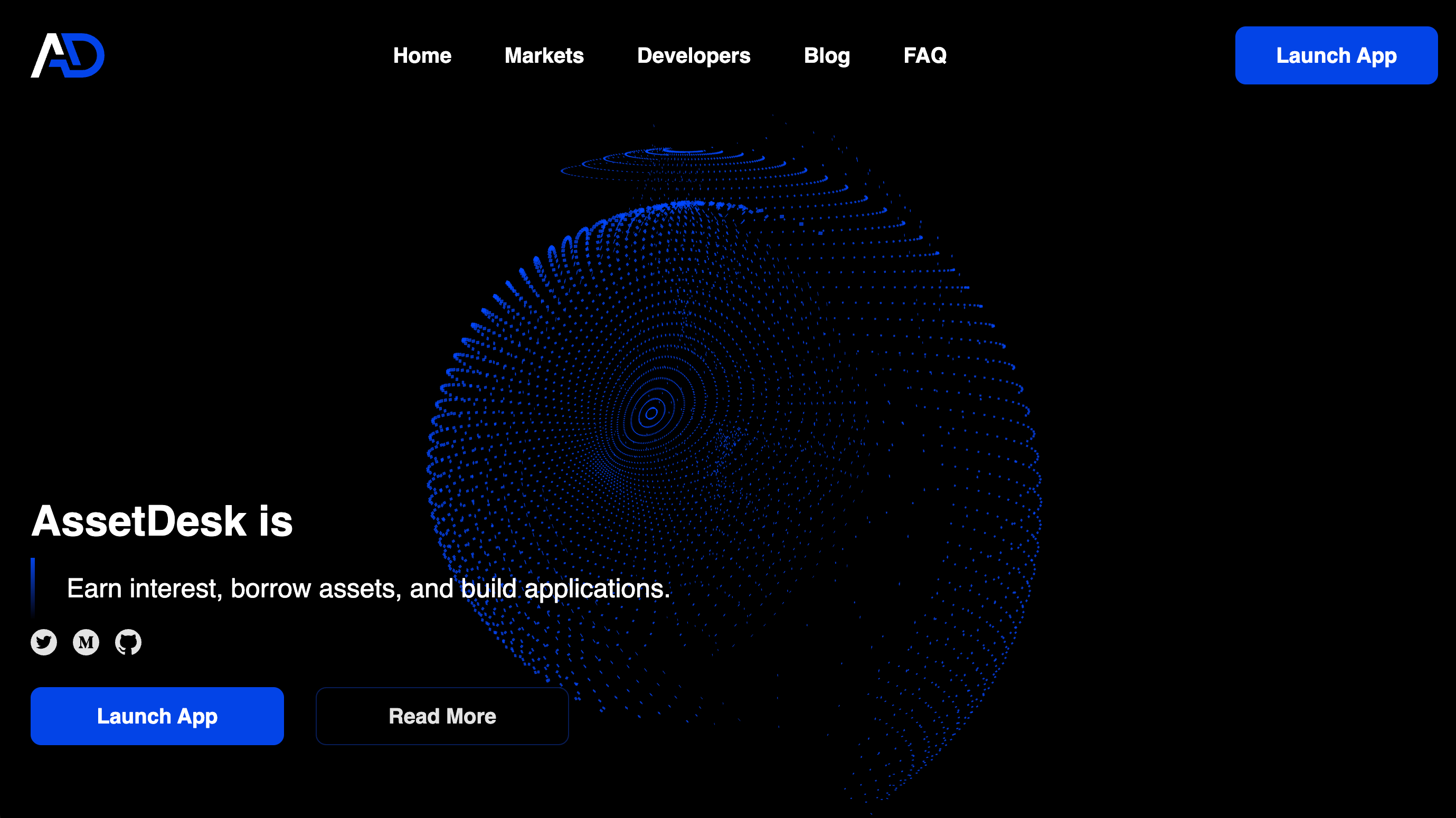

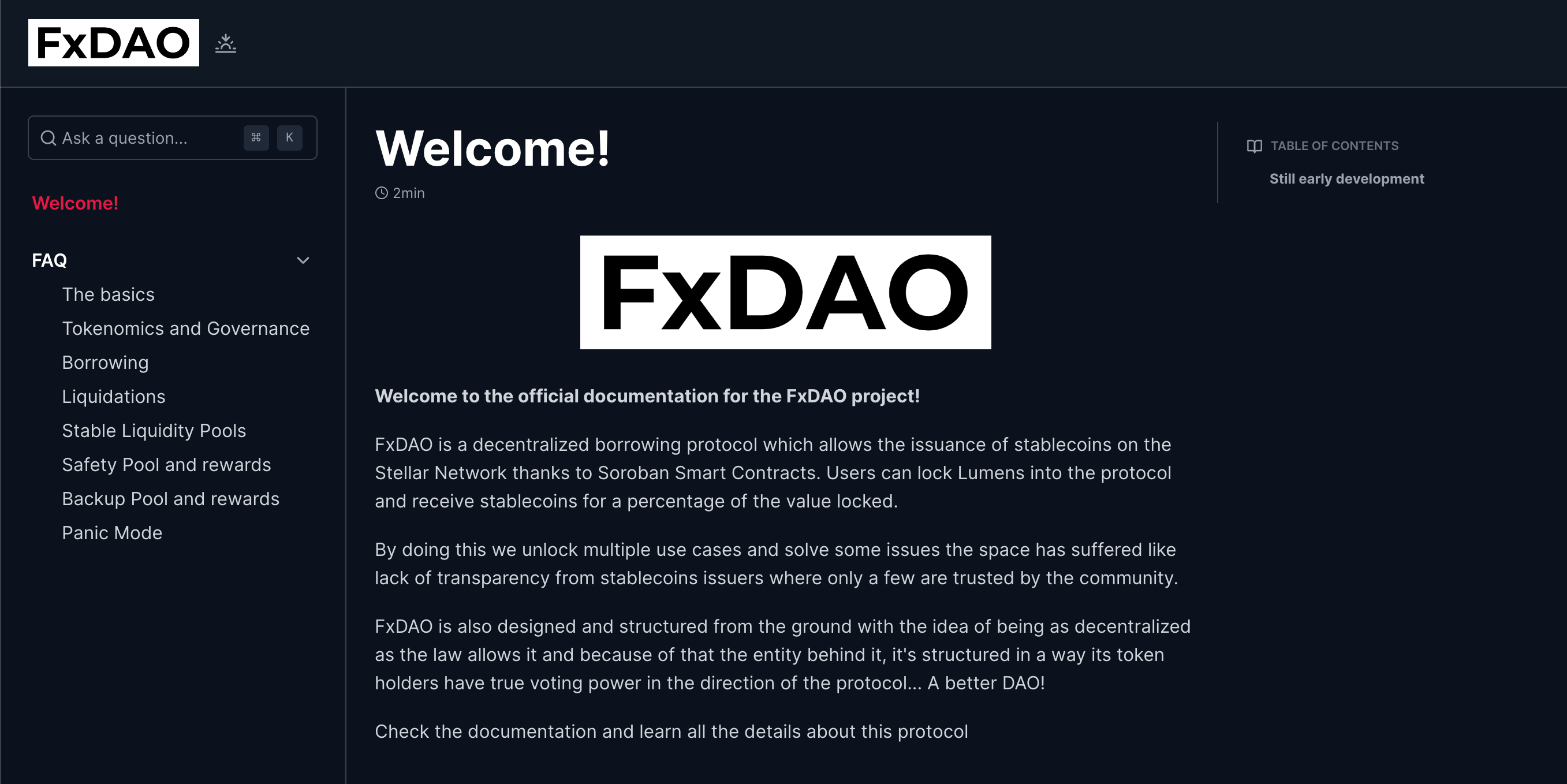

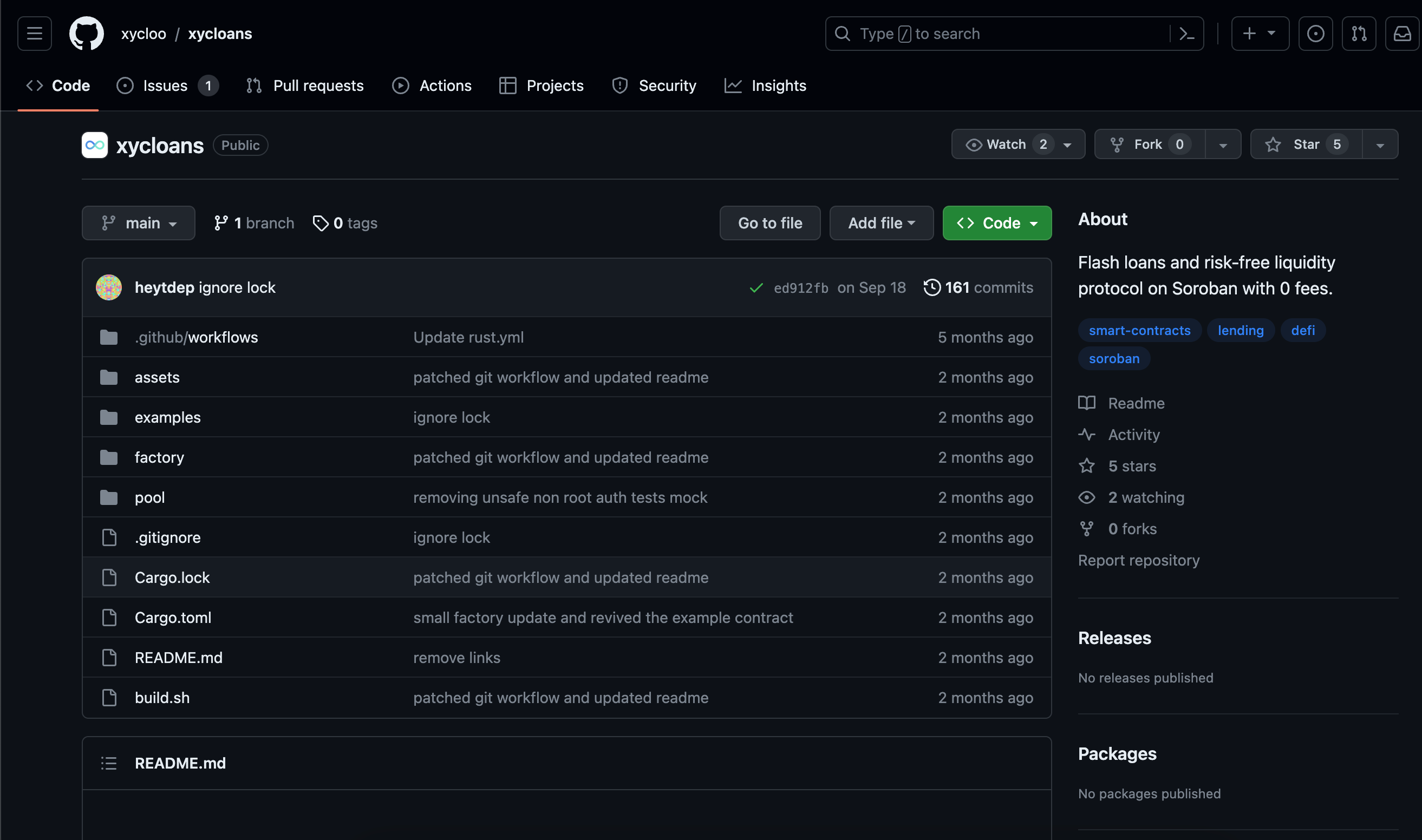

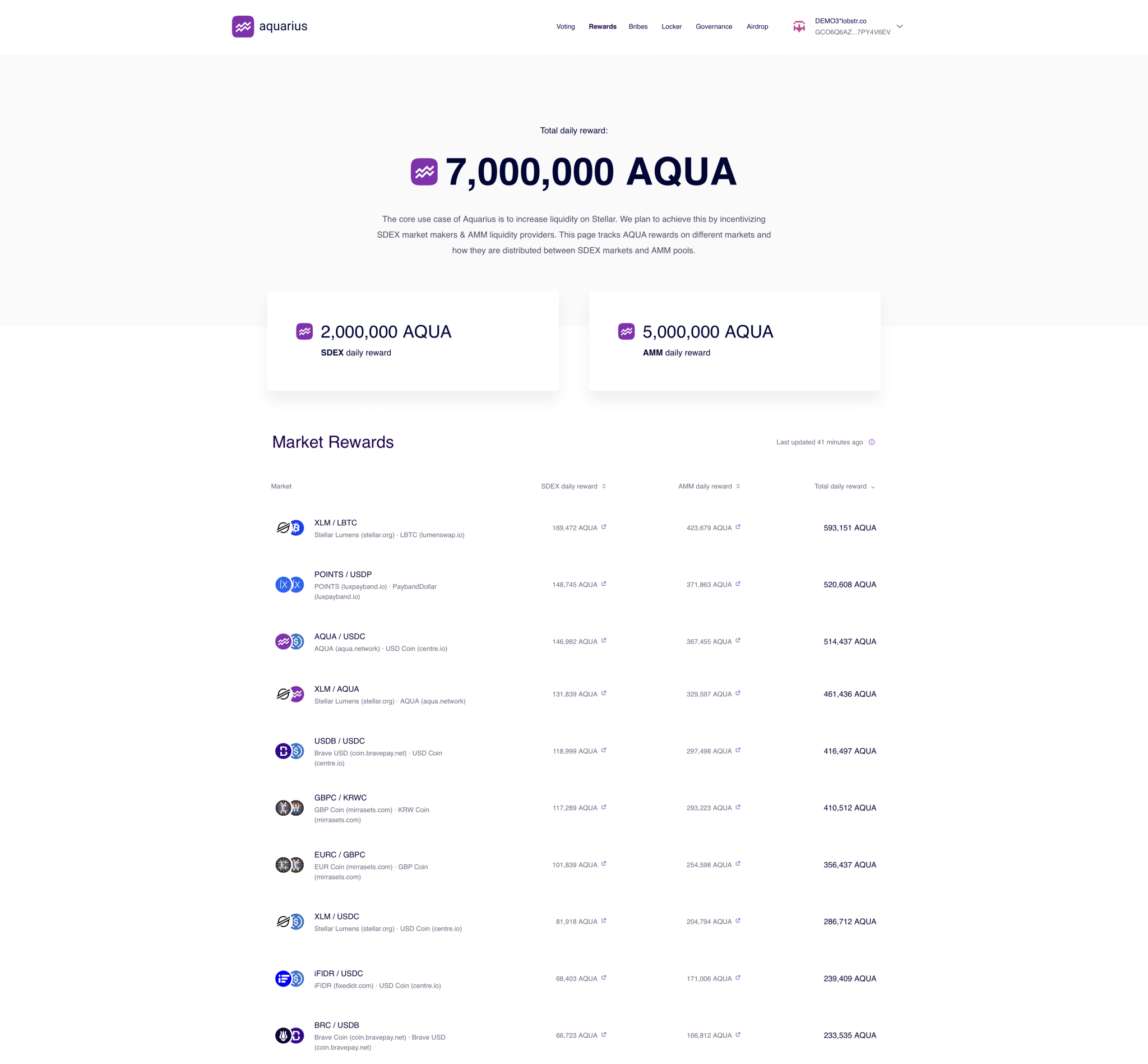

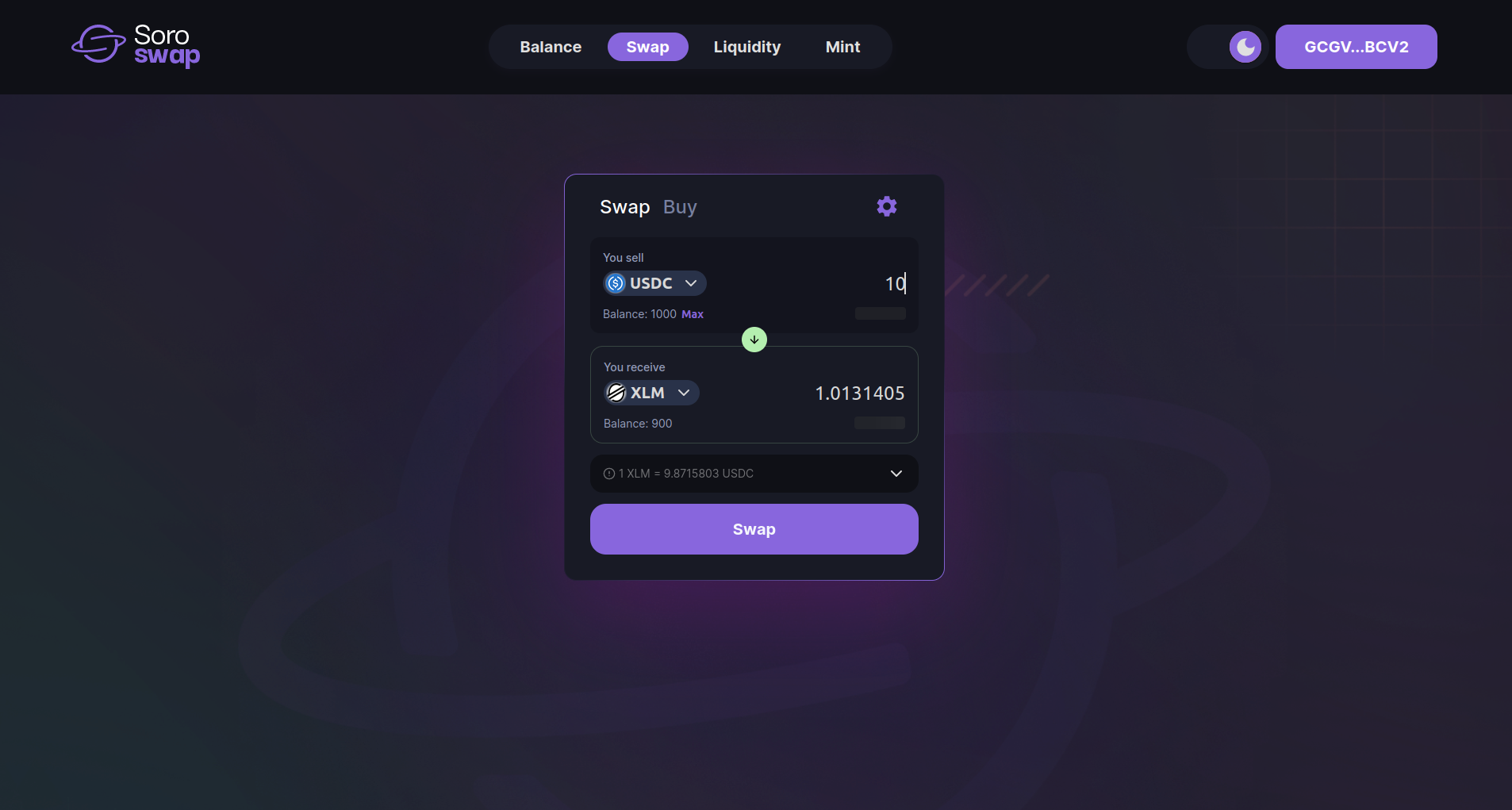

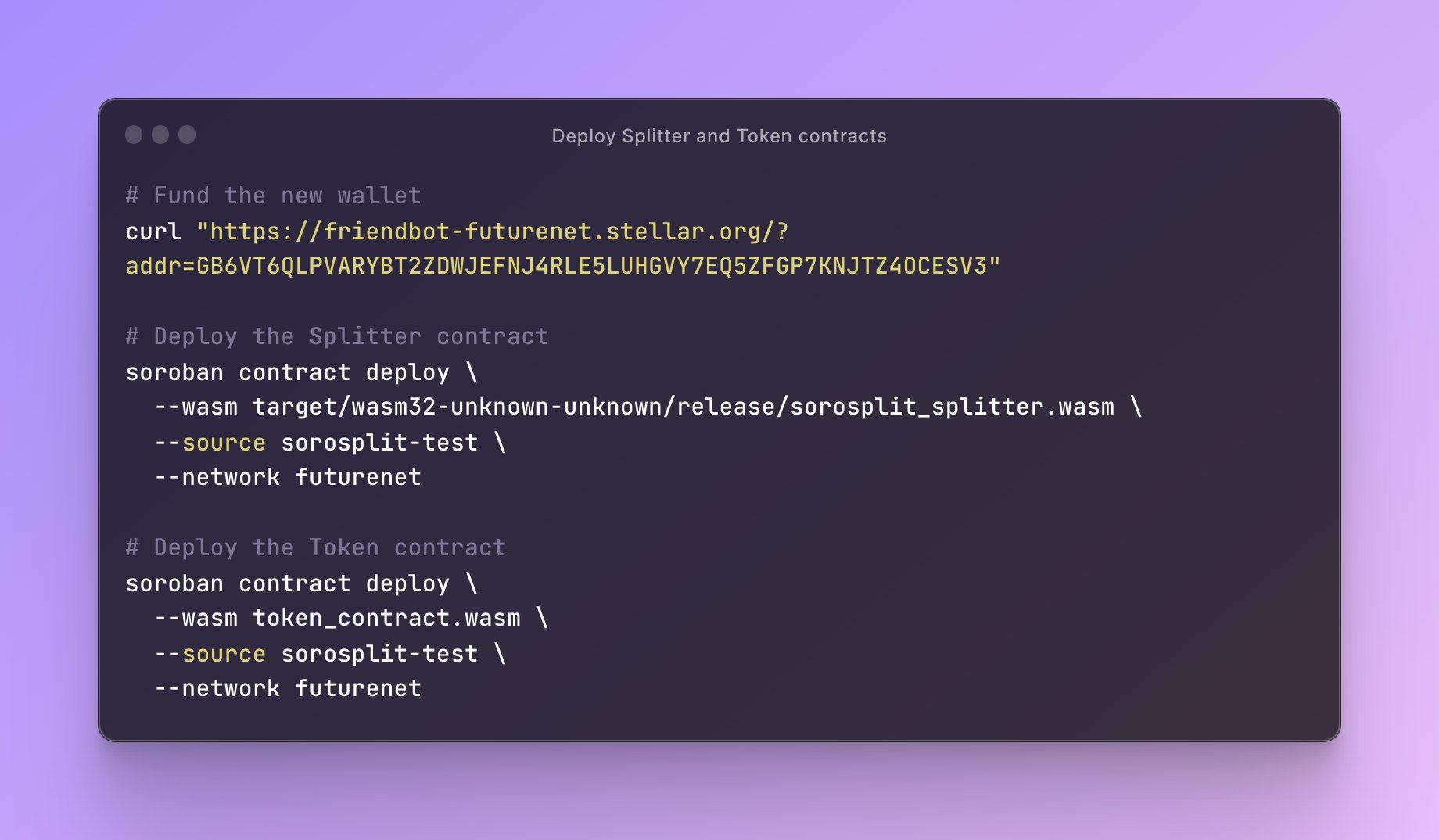

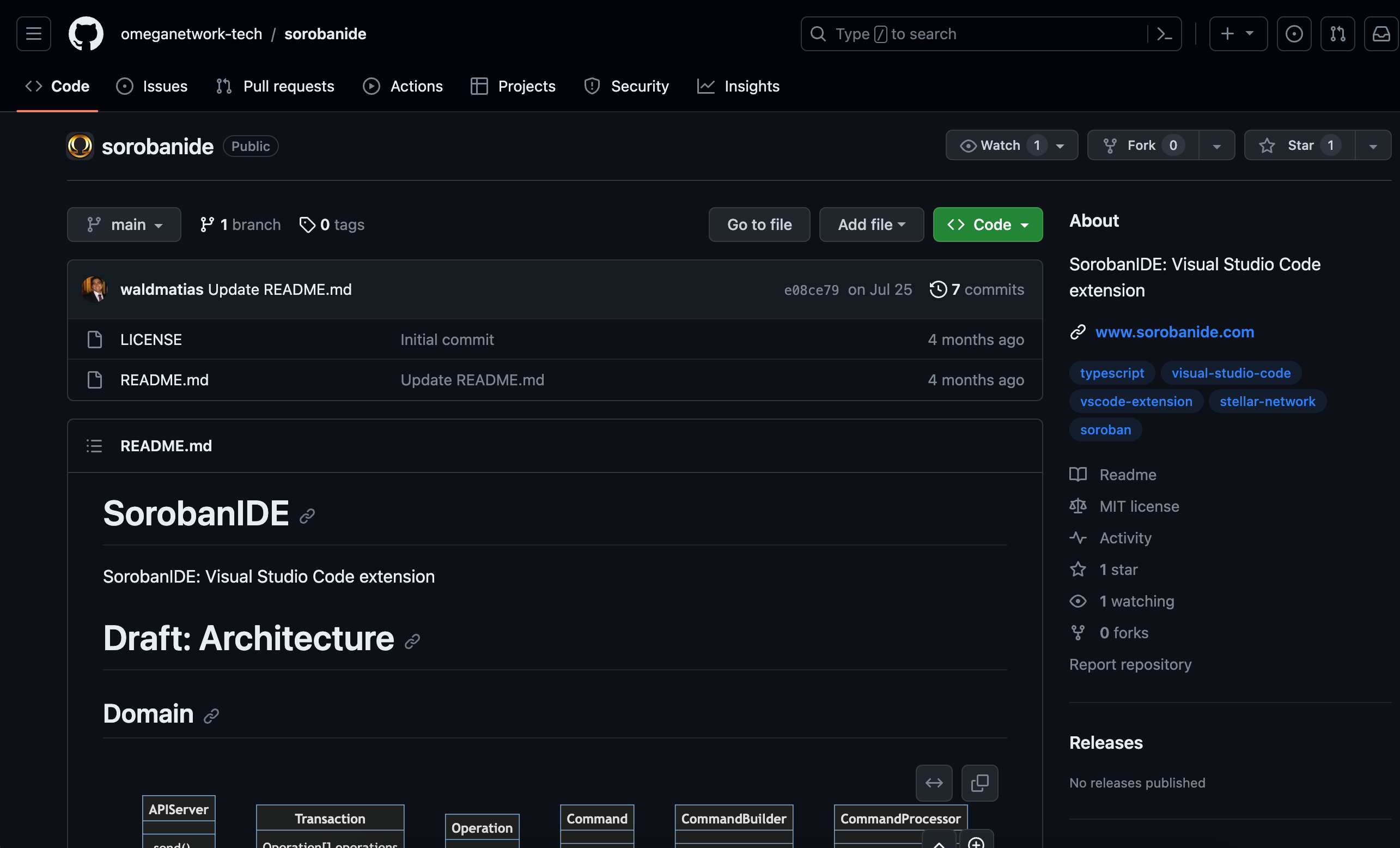

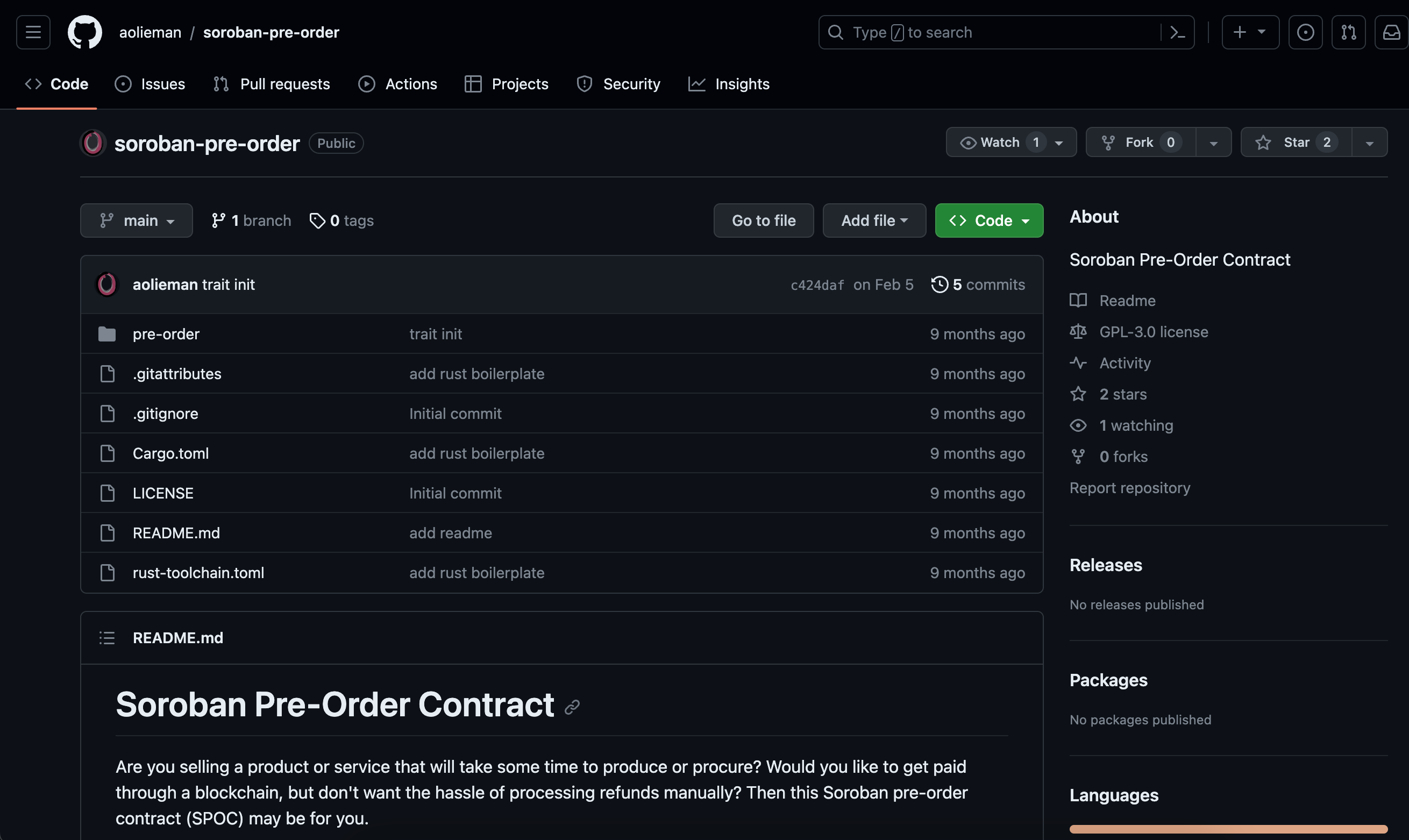

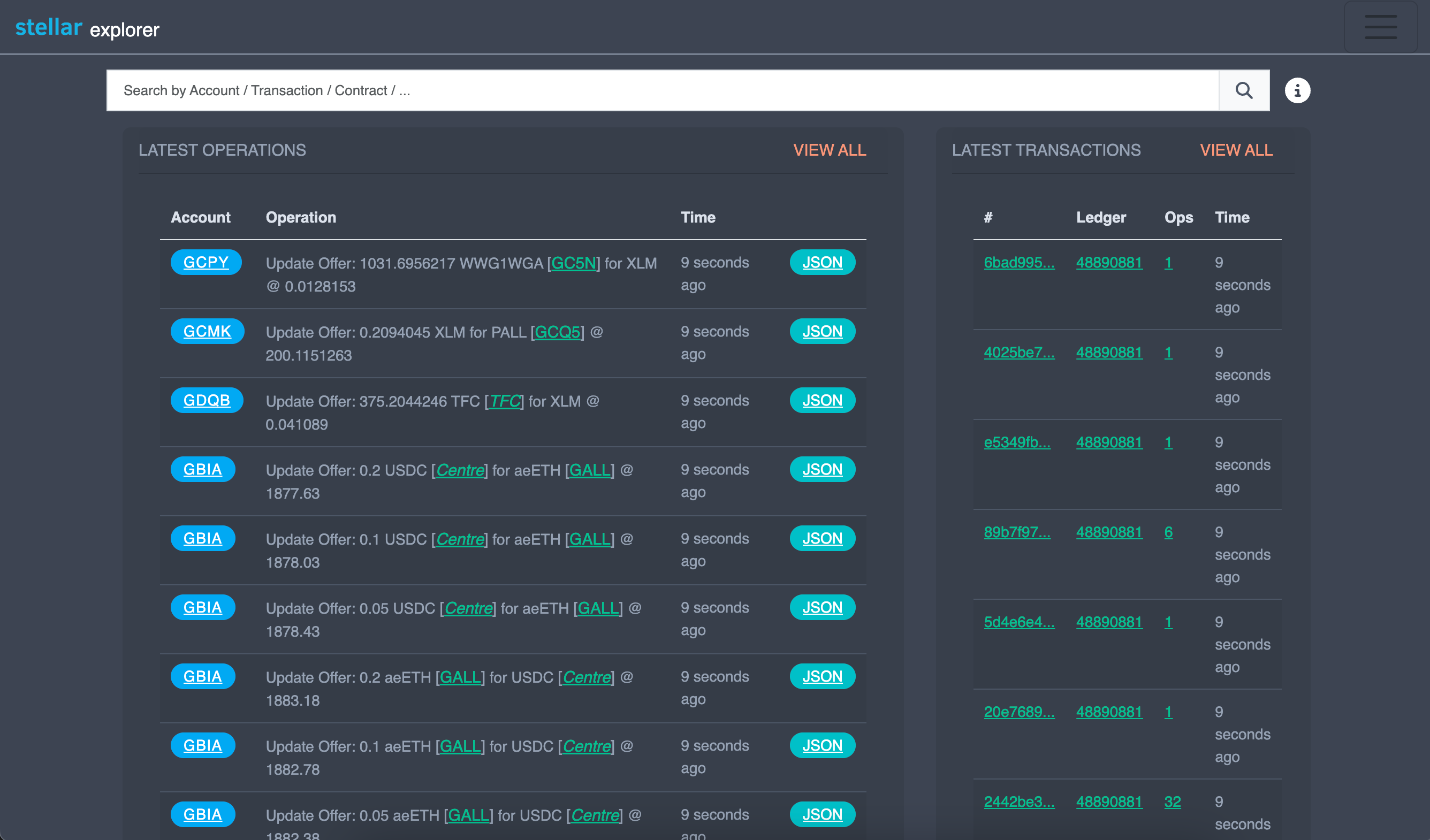

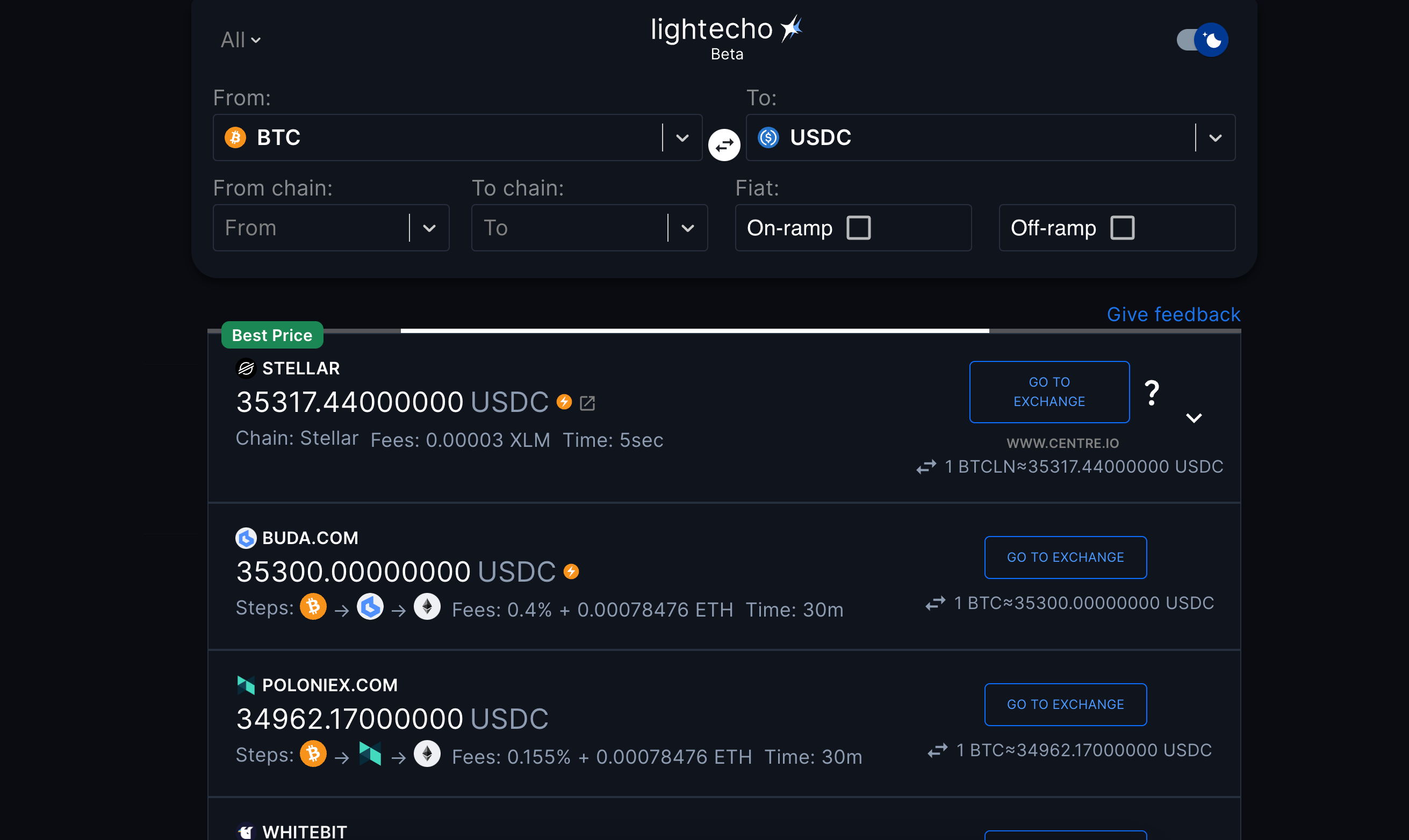

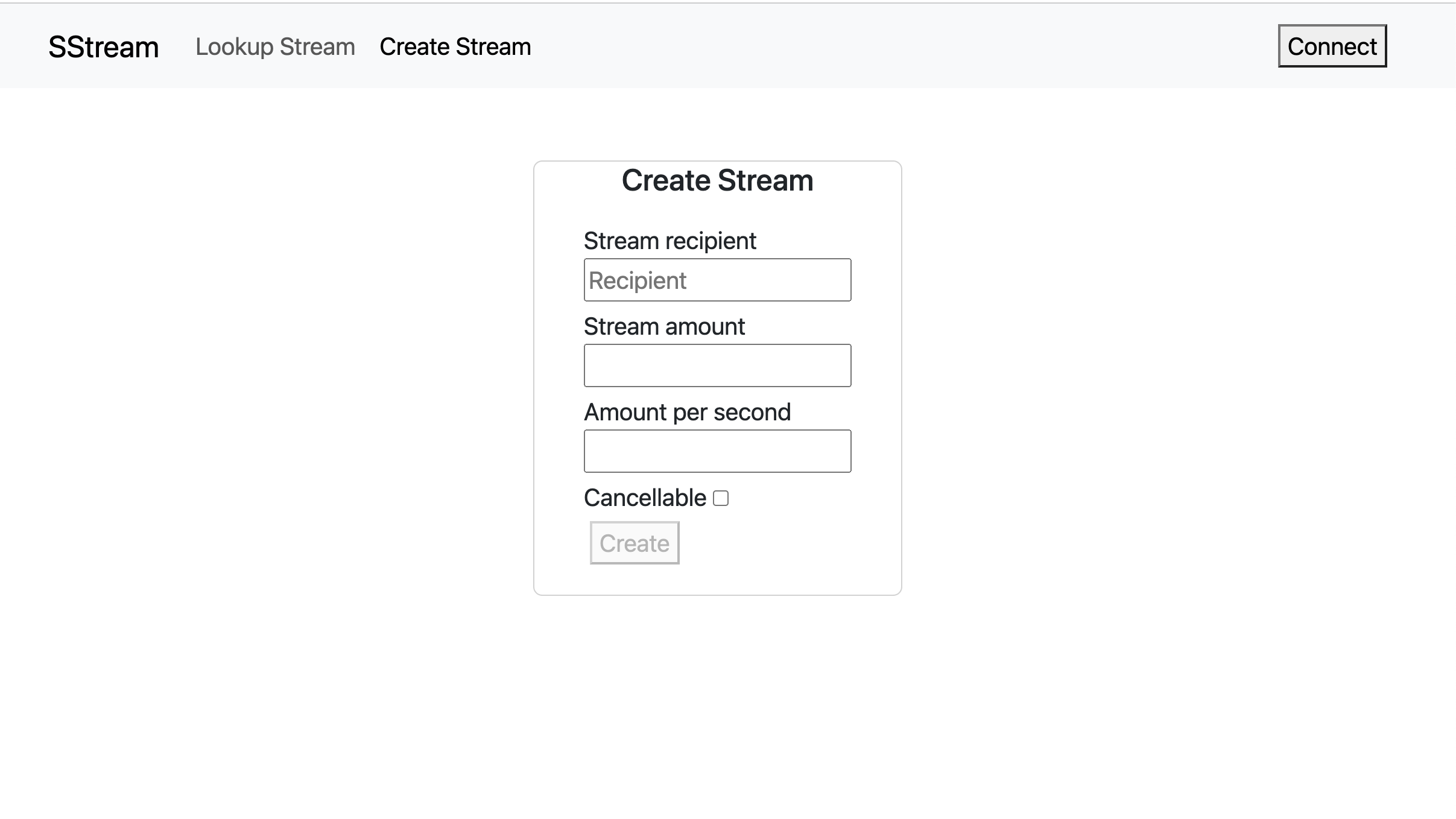

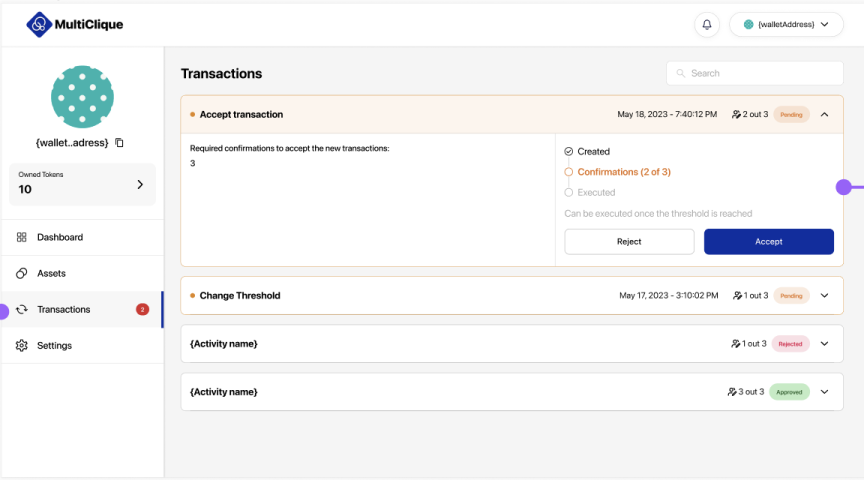

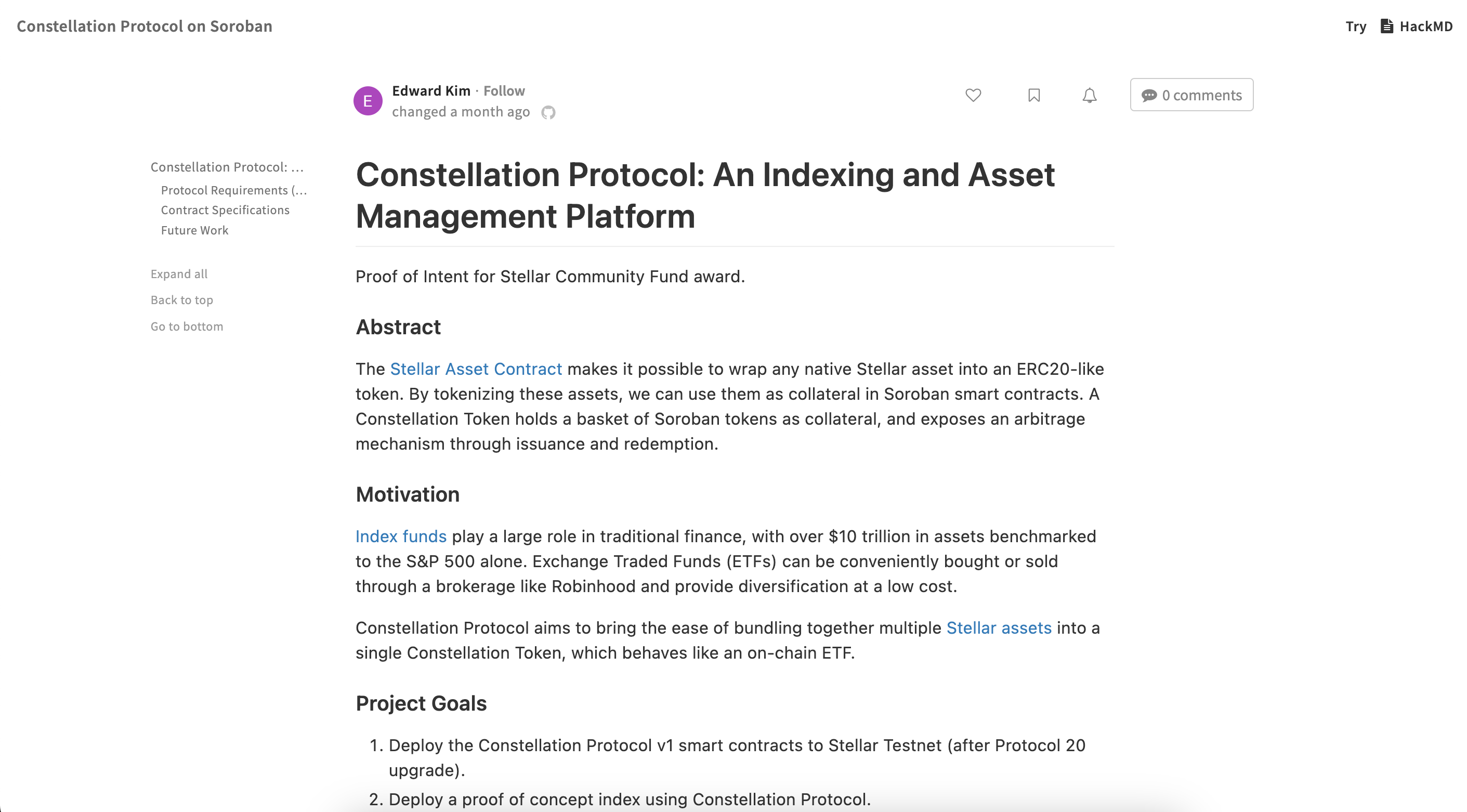

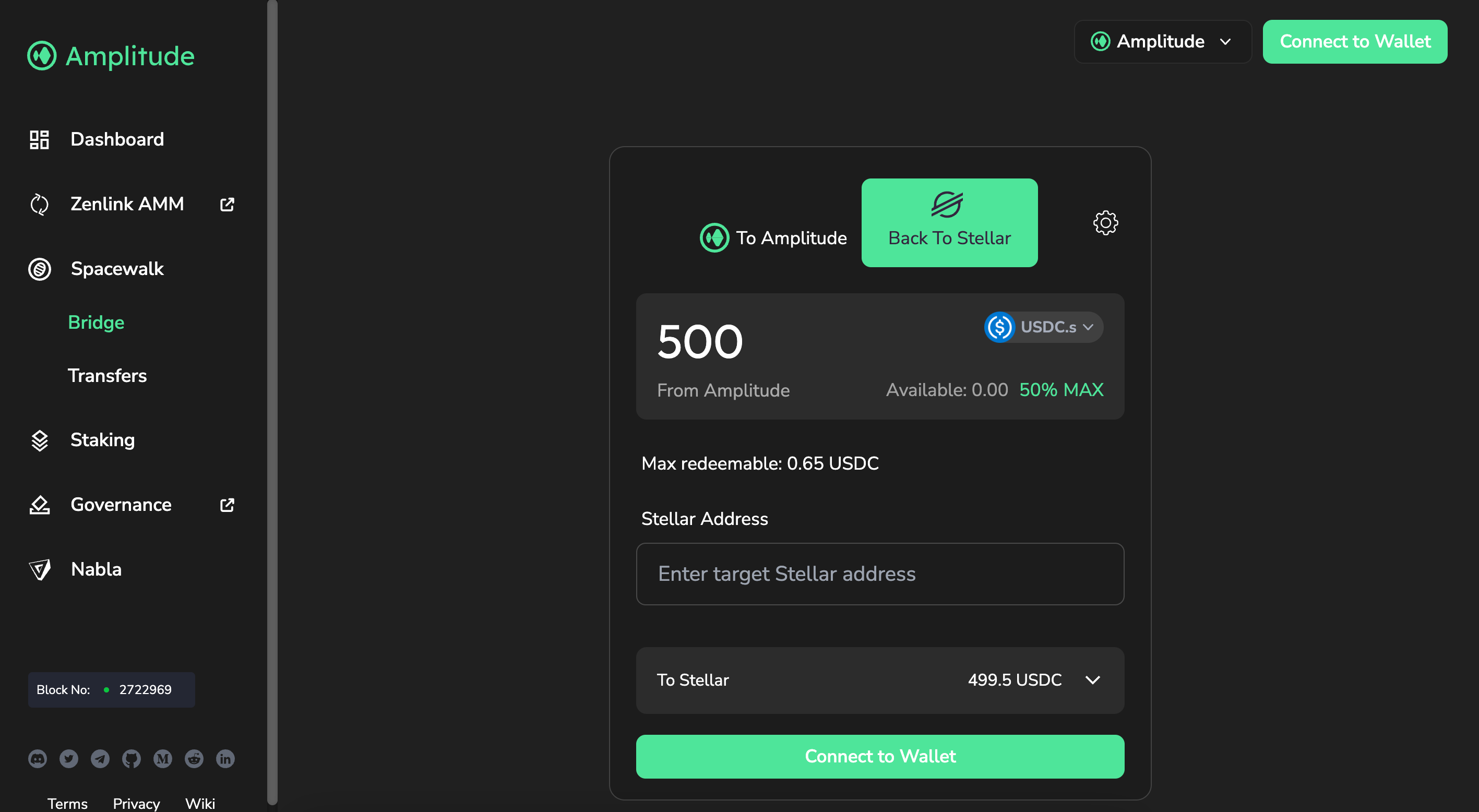

DeFi

Applications

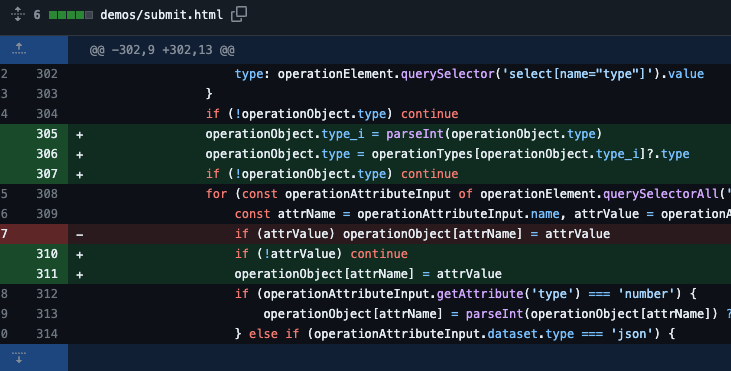

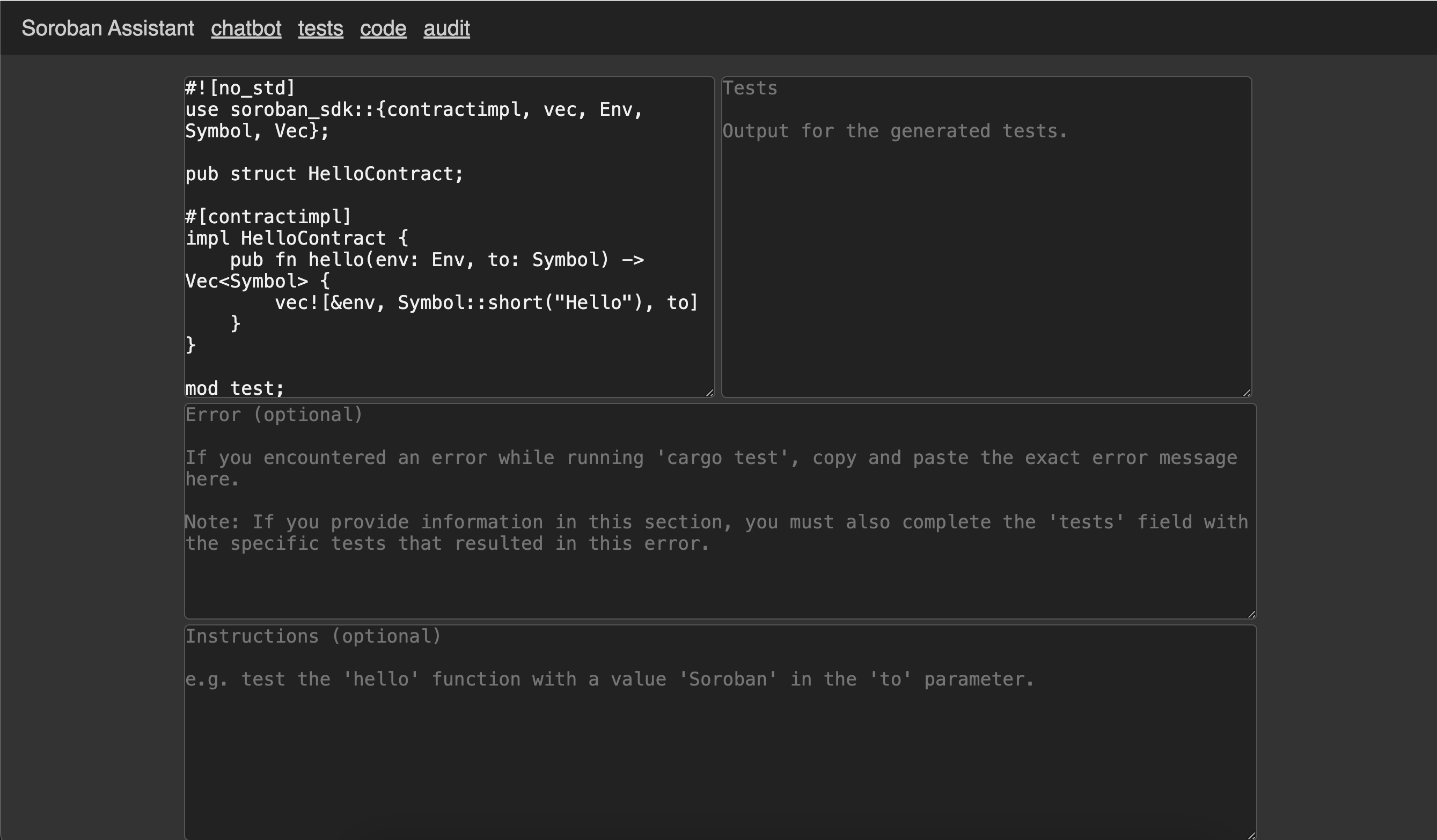

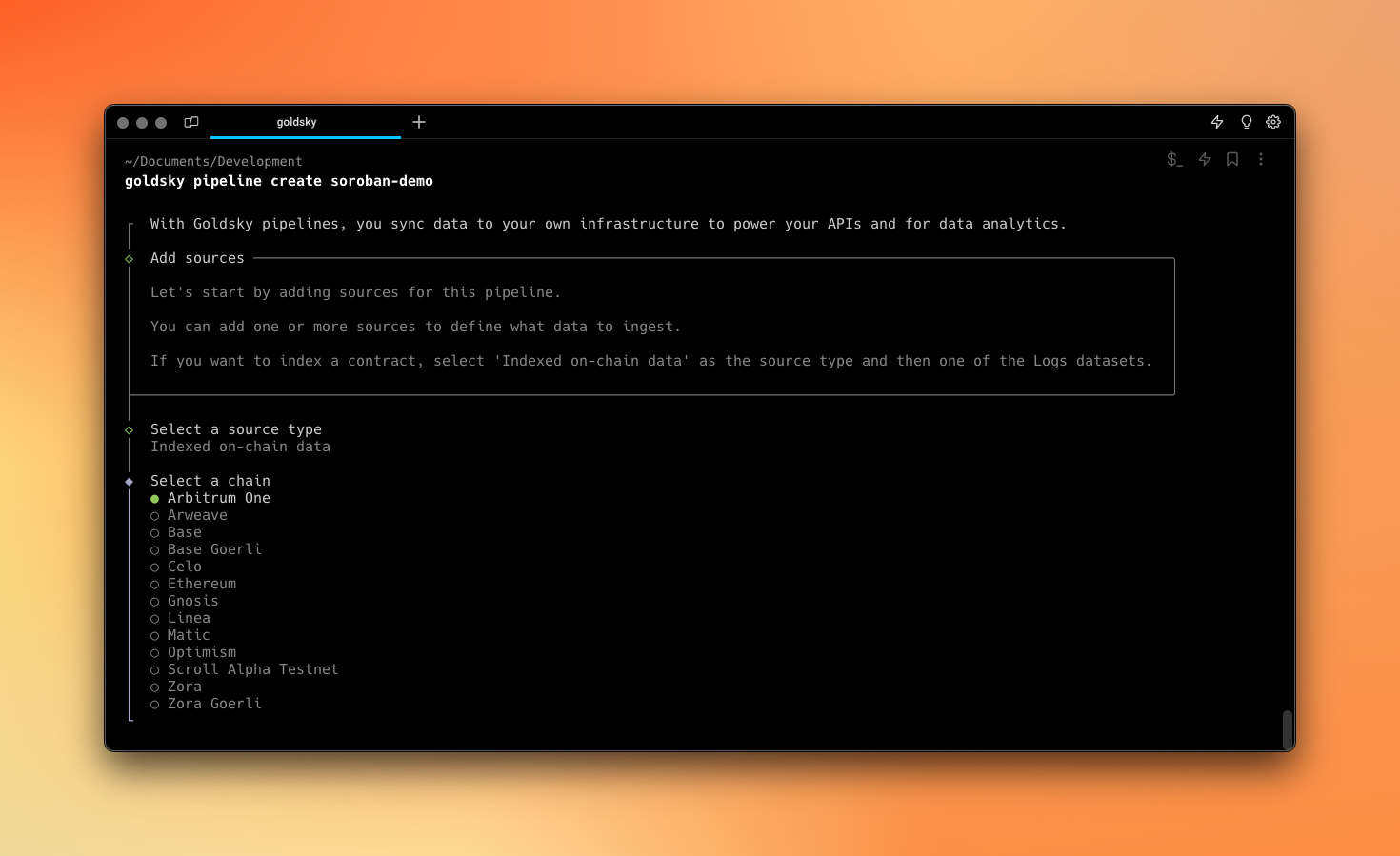

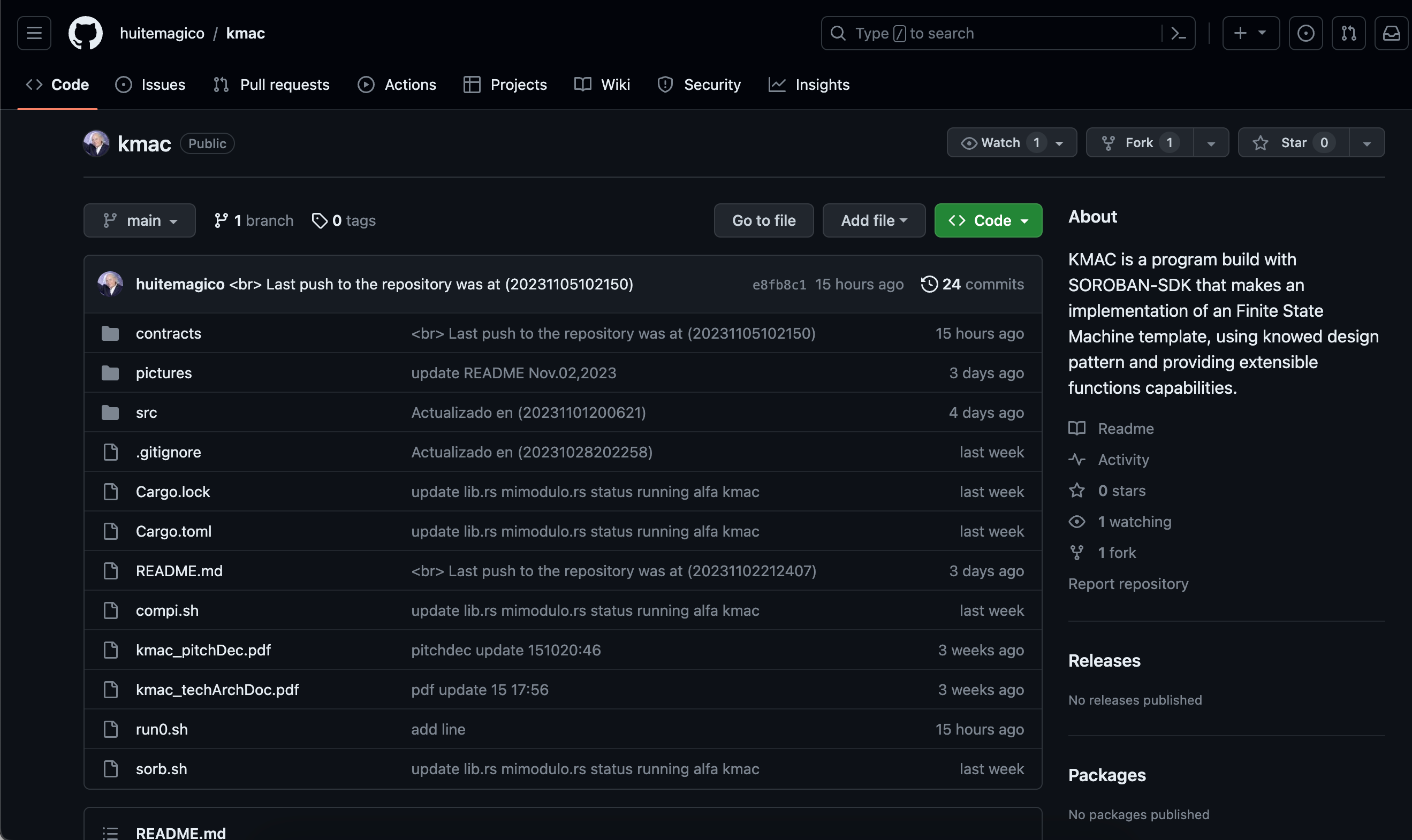

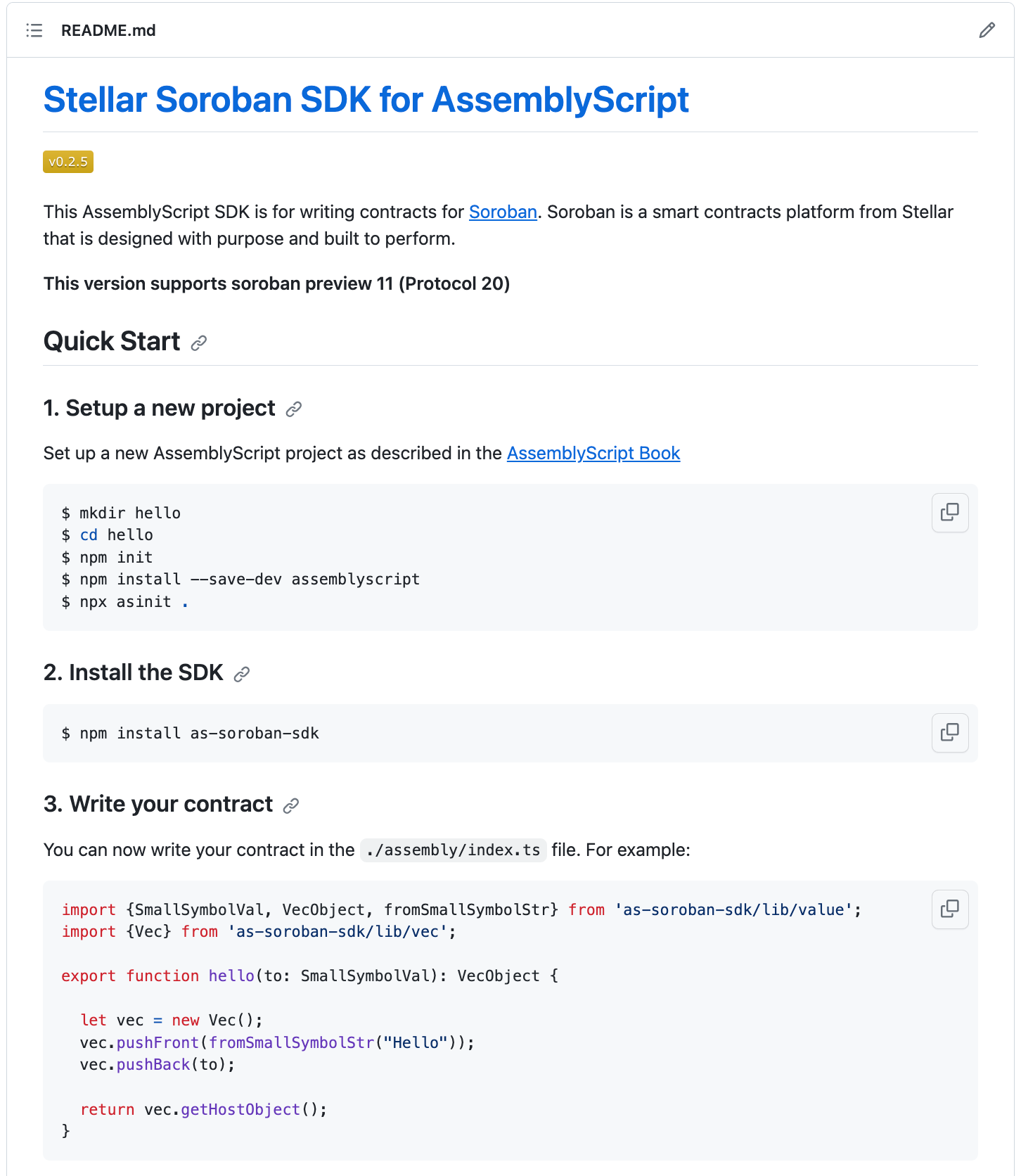

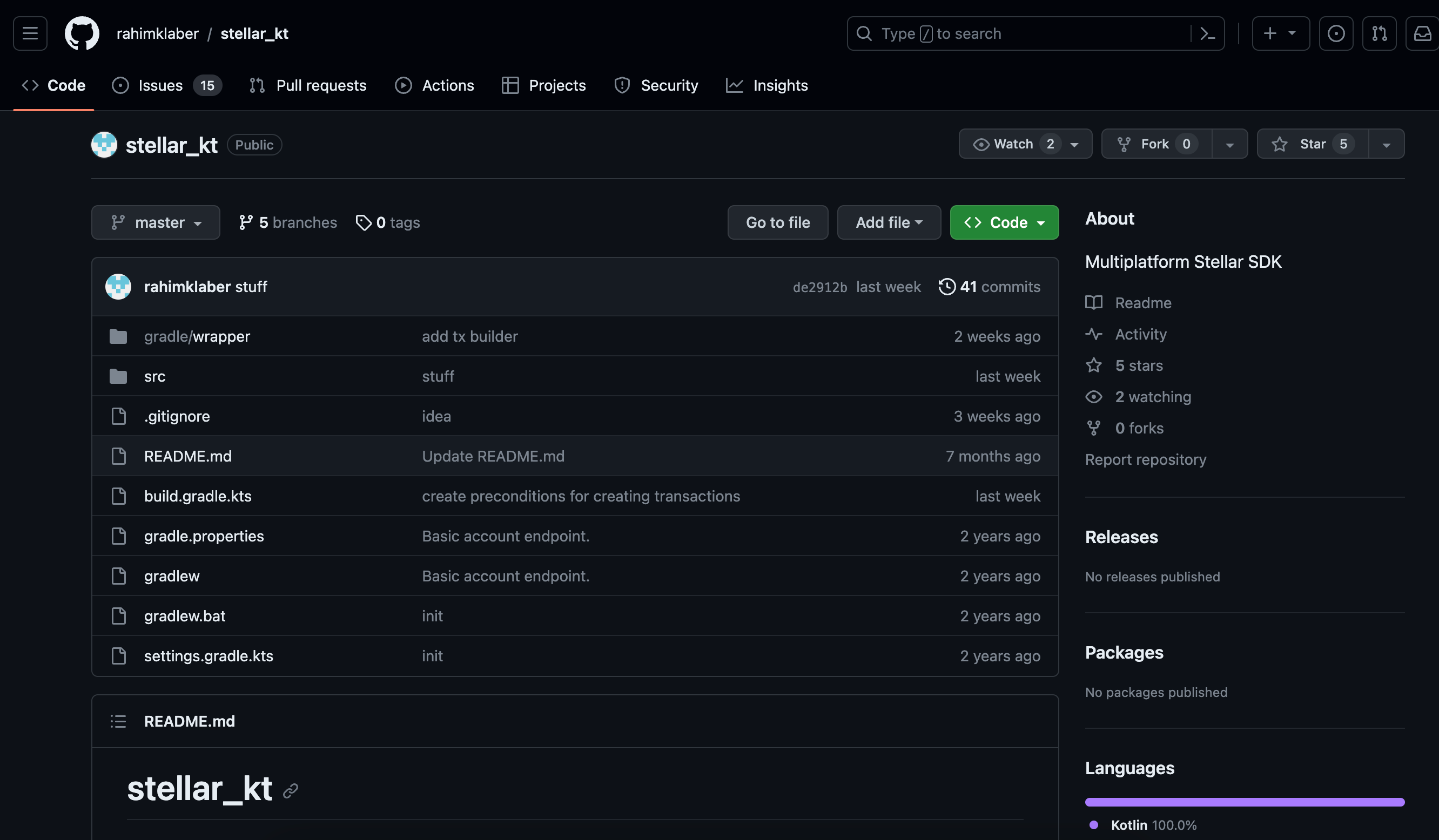

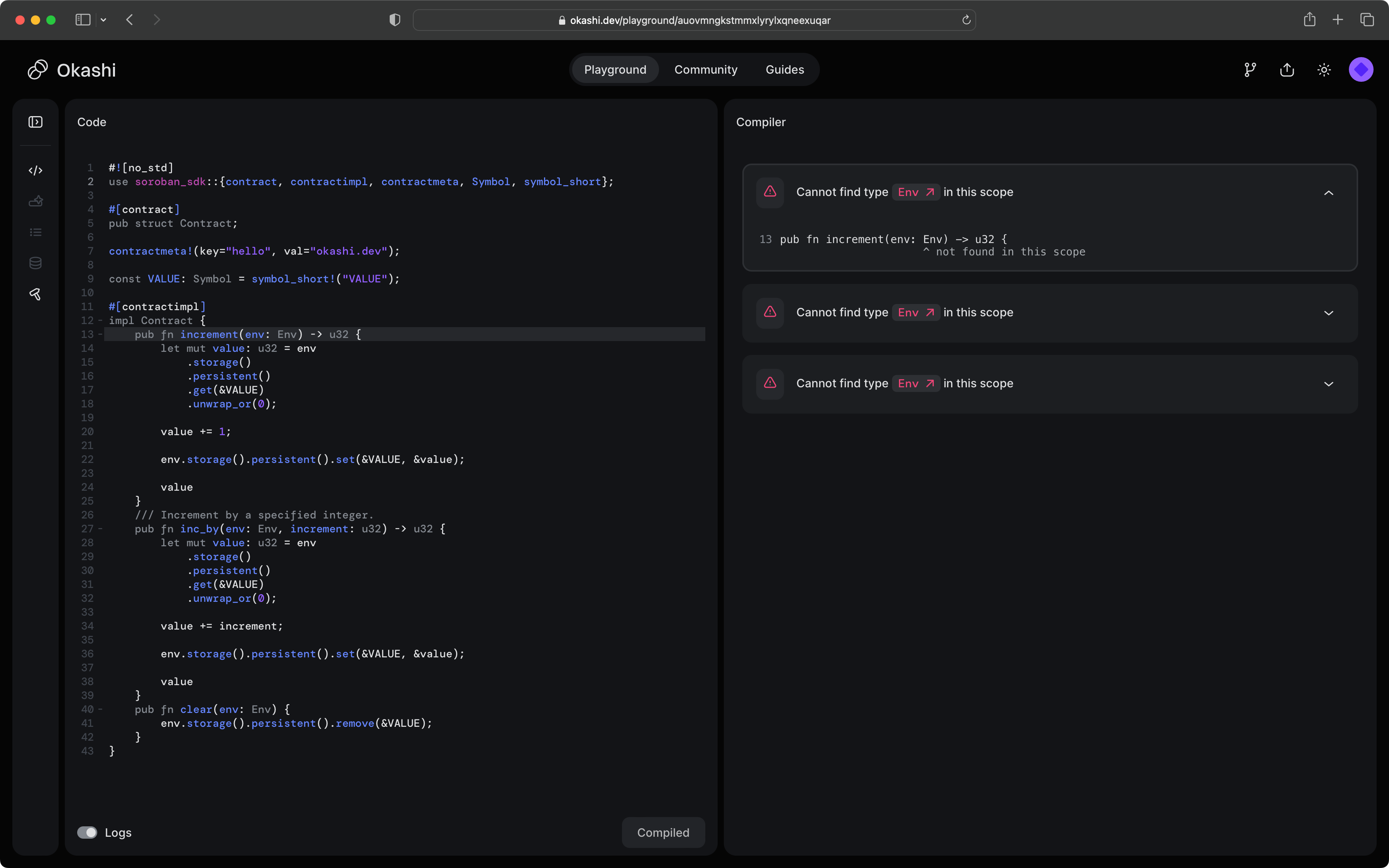

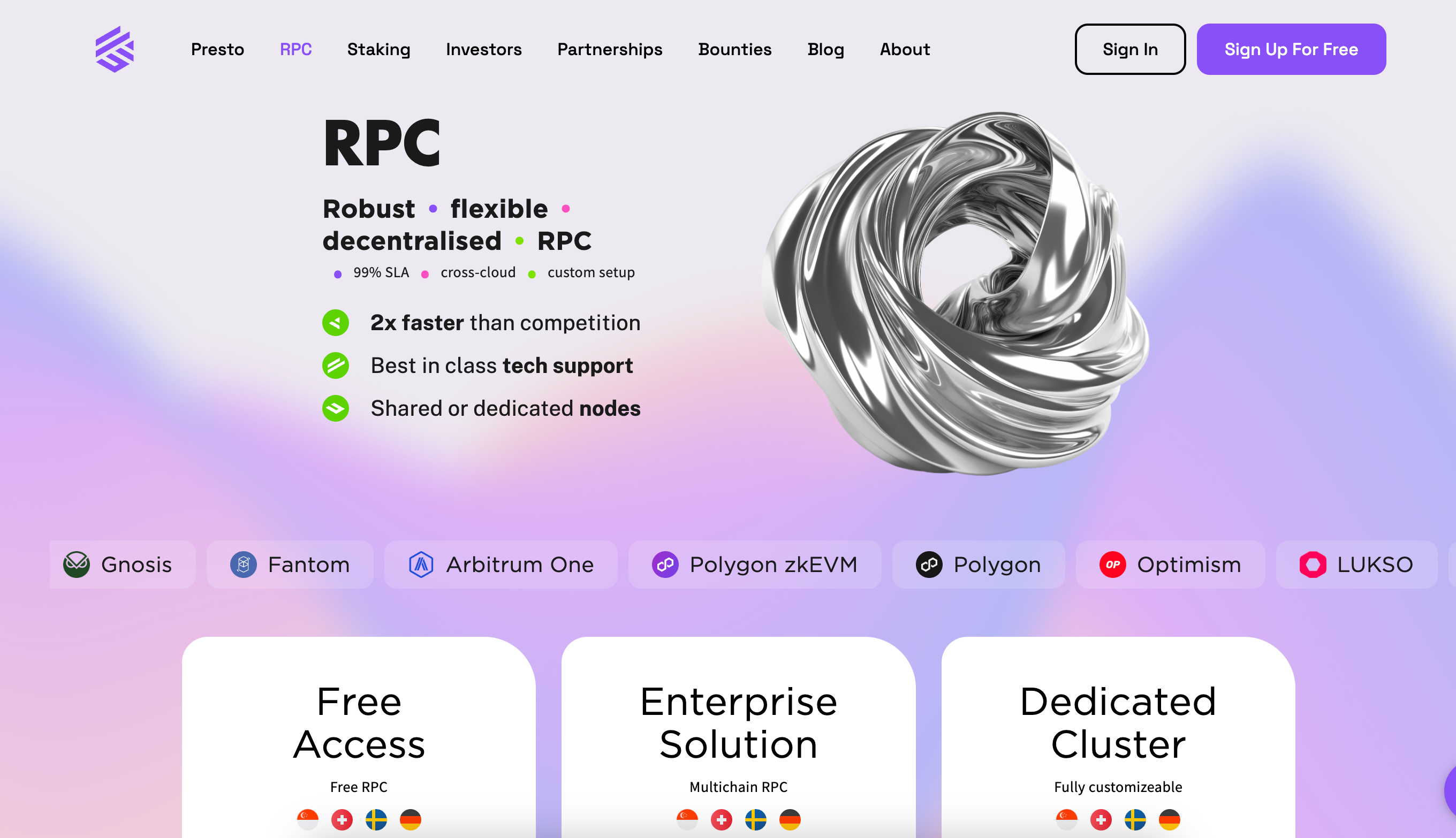

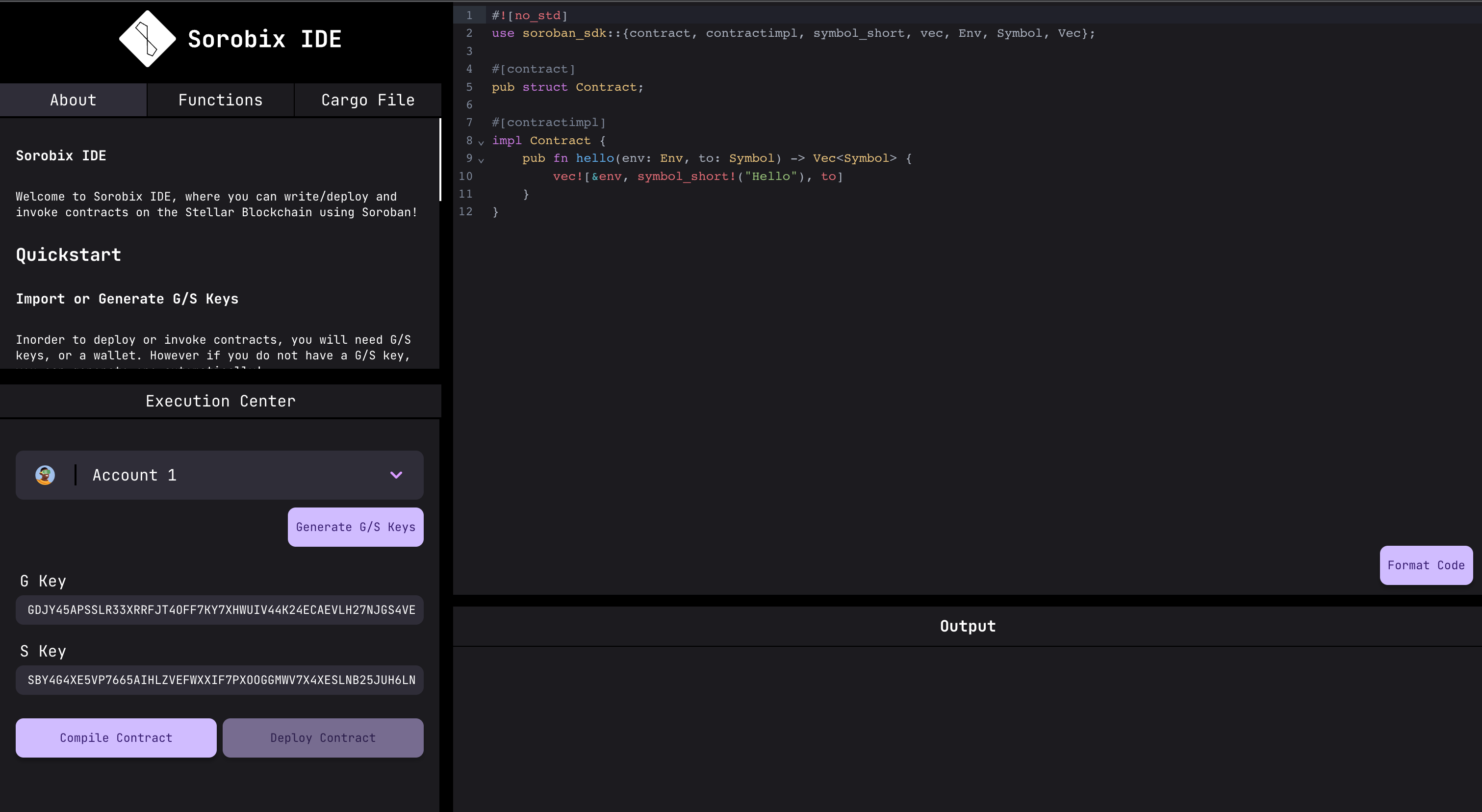

Infrastructure

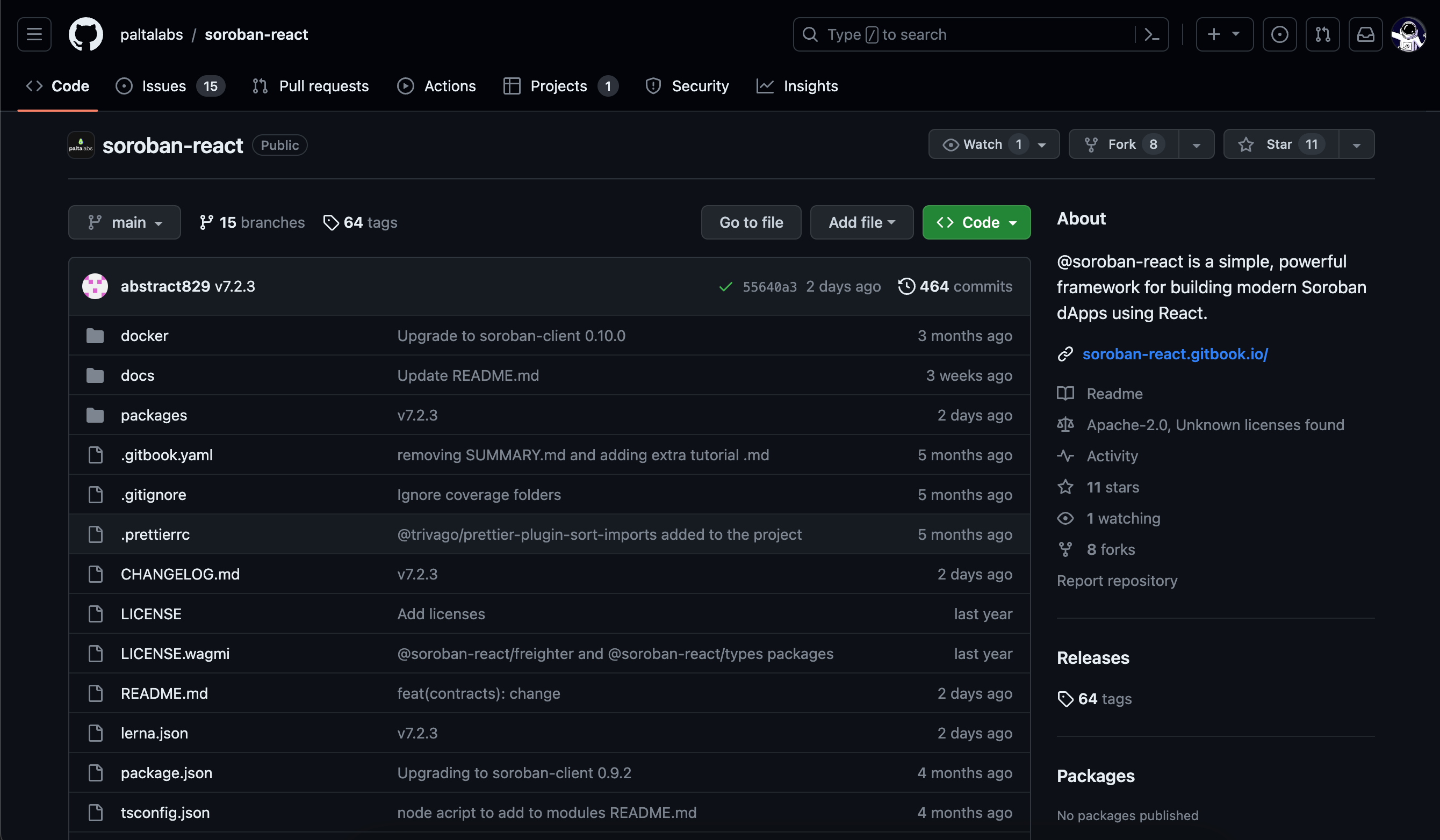

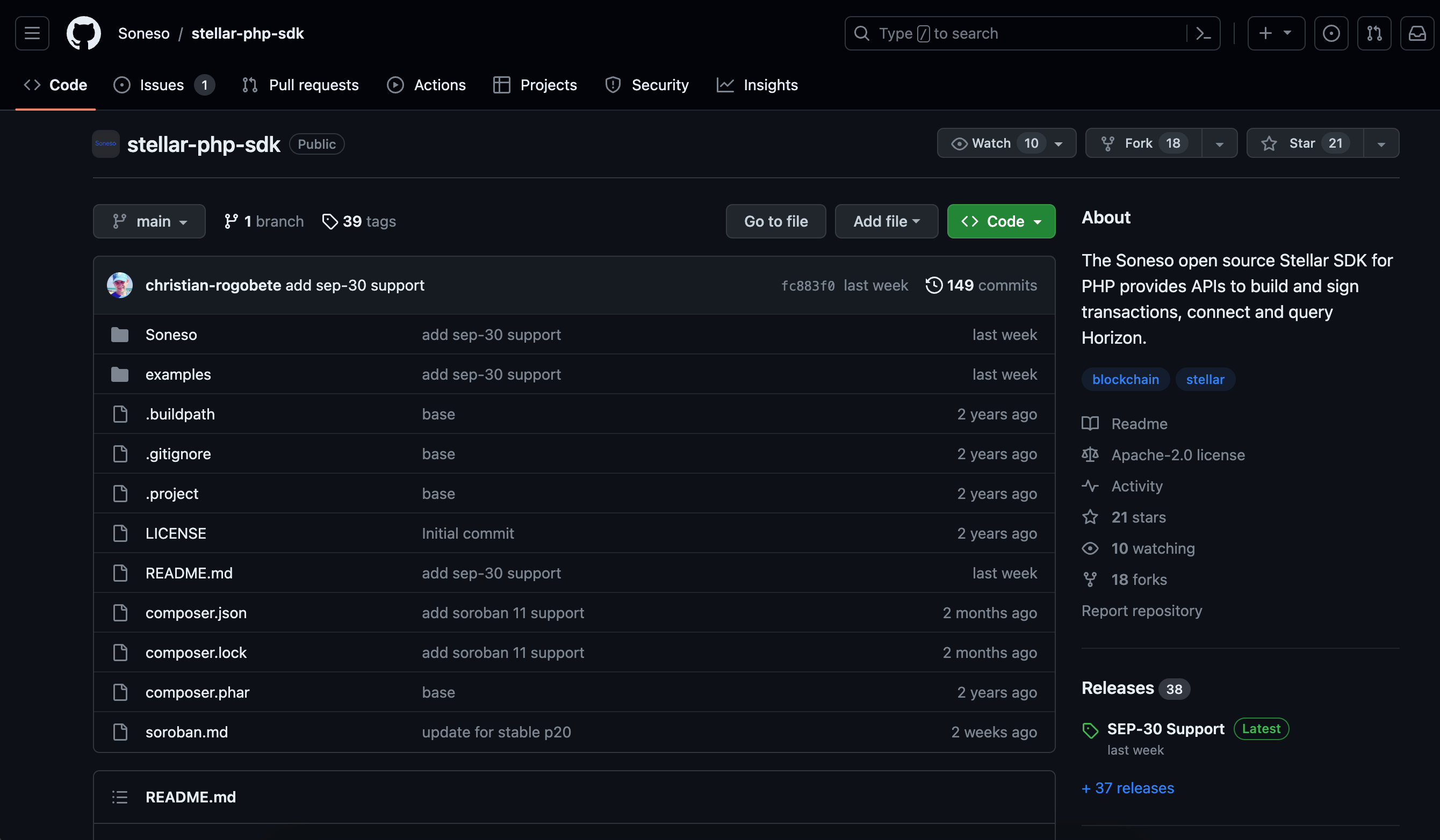

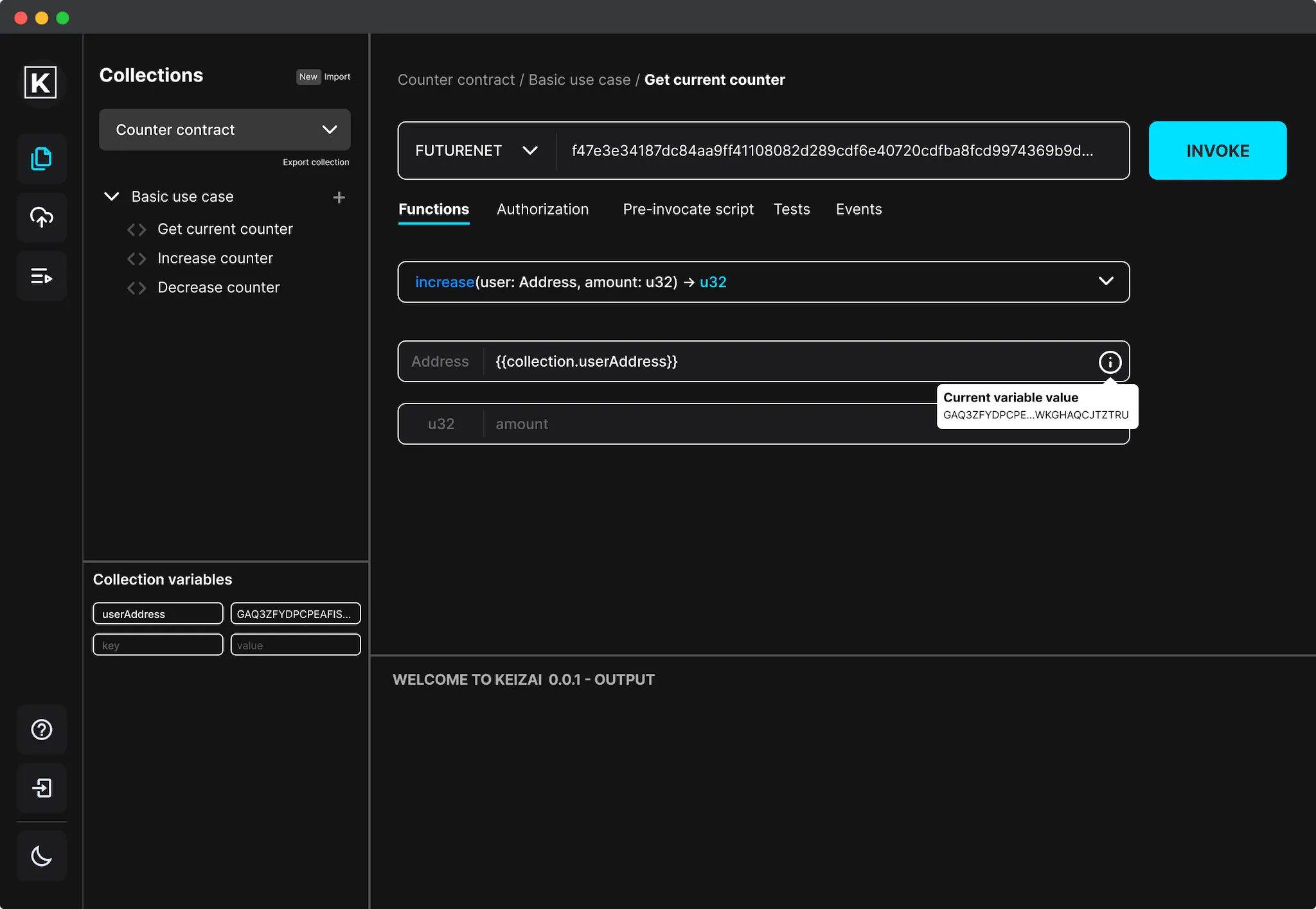

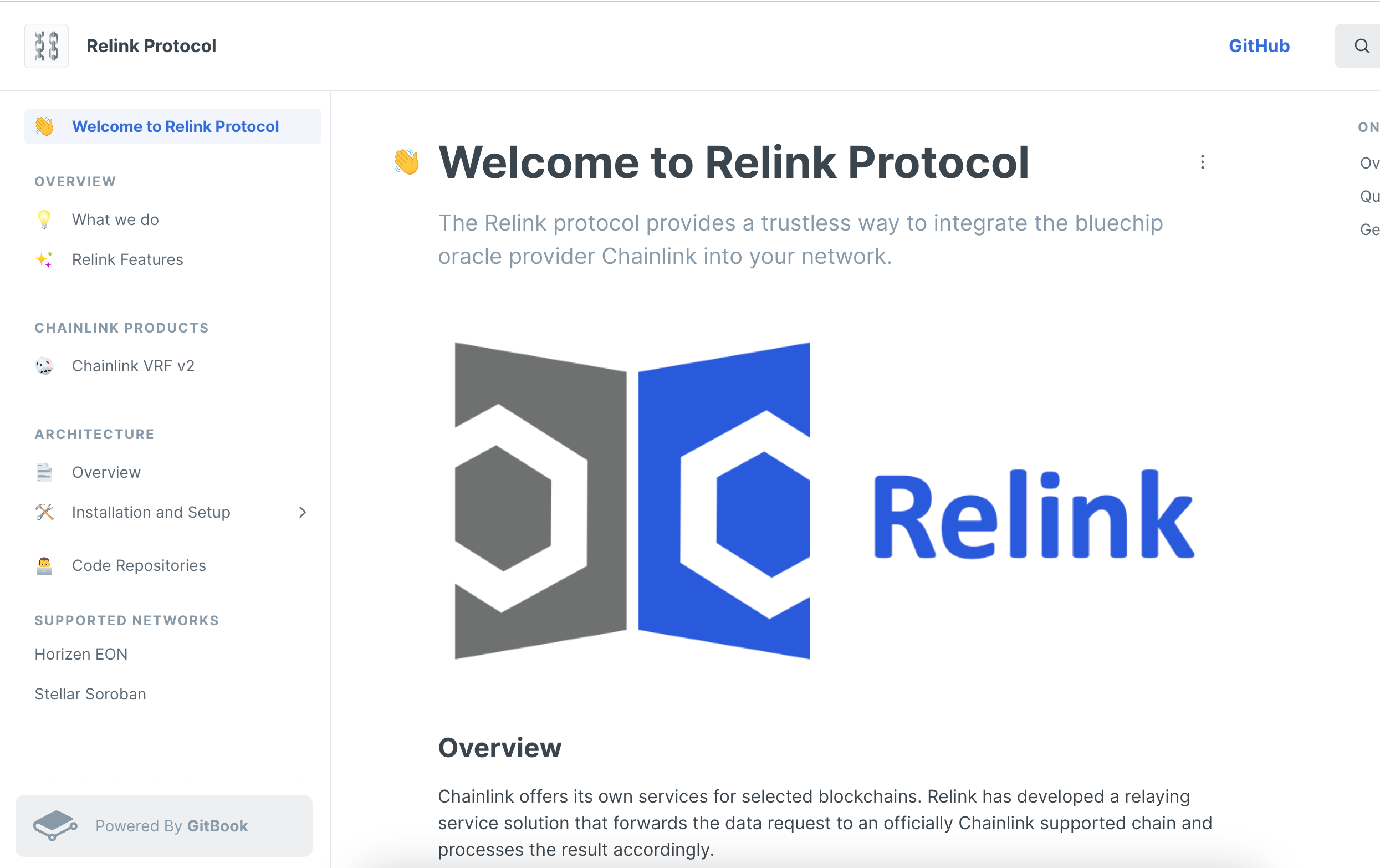

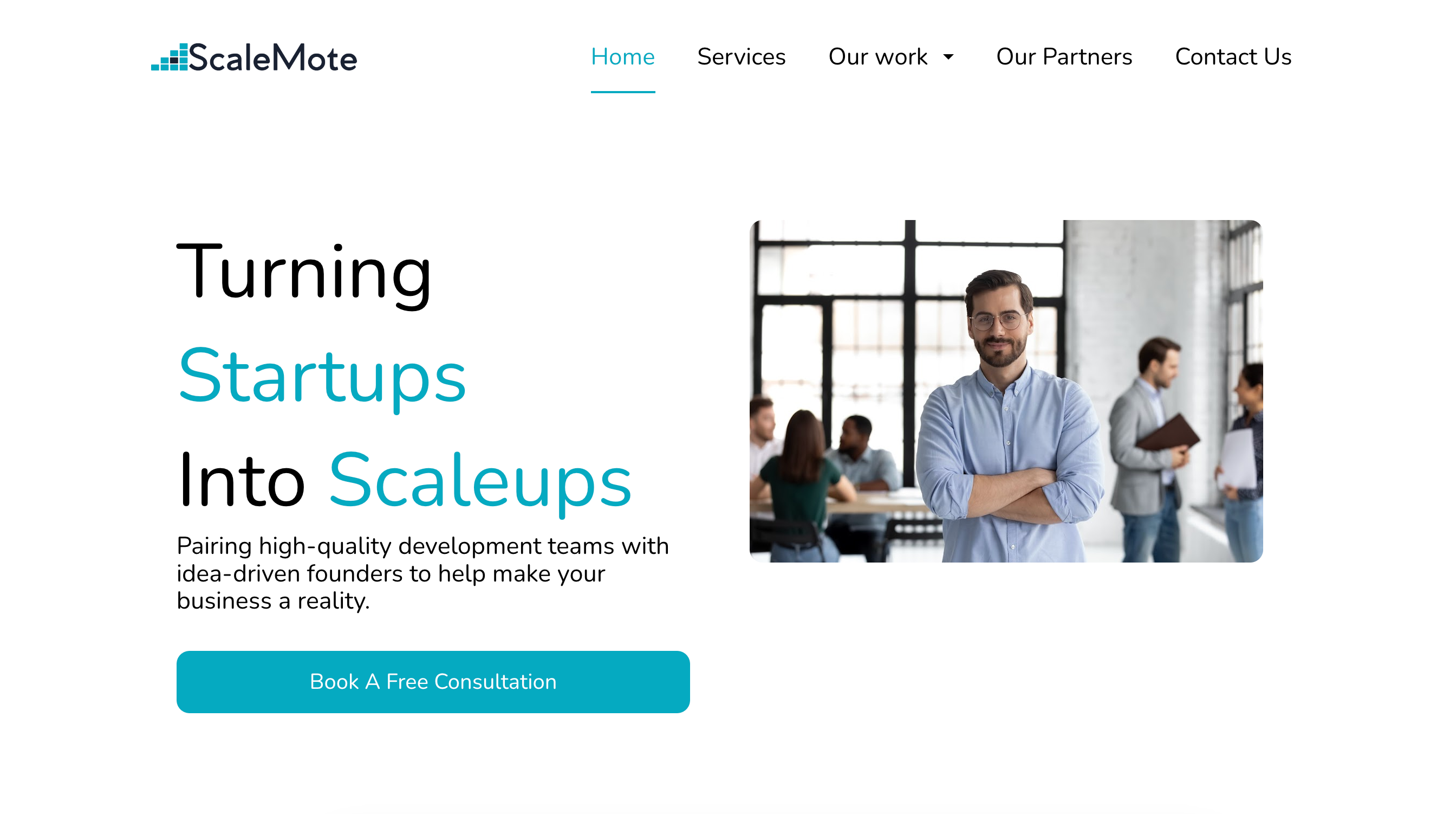

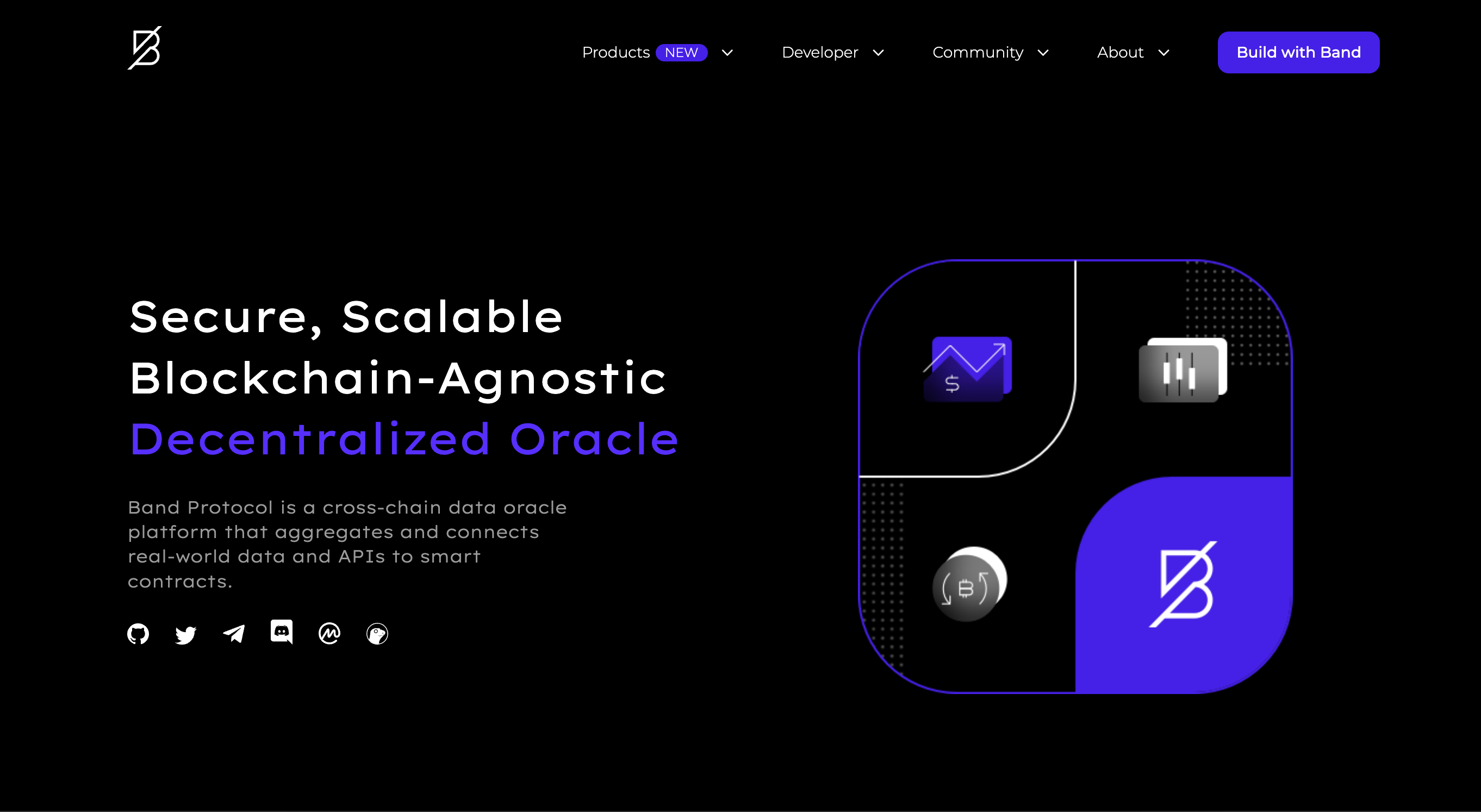

Supporting developers, startups, and full-fledged companies building on Stellar and Soroban

© 2023 Stellar Development Foundation

Subscribe to the Newsletter